18 analysts have shared their evaluations of Okta OKTA during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 11 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 4 | 0 | 0 |

| 3M Ago | 4 | 3 | 6 | 0 | 0 |

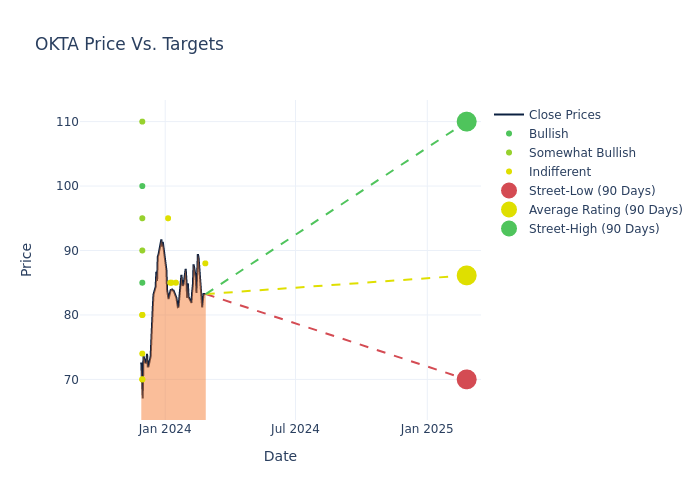

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $85.67, along with a high estimate of $110.00 and a low estimate of $70.00. This upward trend is evident, with the current average reflecting a 1.81% increase from the previous average price target of $84.15.

Understanding Analyst Ratings: A Comprehensive Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Okta. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Essex | JP Morgan | Raises | Neutral | $88.00 | $74.00 |

| Gregory Miller | Truist Securities | Raises | Hold | $85.00 | $70.00 |

| Fatima Boolani | Citigroup | Raises | Neutral | $85.00 | $75.00 |

| Gregg Moskowitz | Mizuho | Announces | Neutral | $85.00 | - |

| Brent Thill | Jefferies | Raises | Hold | $95.00 | $85.00 |

| Peter Levine | Evercore ISI Group | Lowers | In-Line | $70.00 | $75.00 |

| Adam Borg | Stifel | Lowers | Buy | $85.00 | $100.00 |

| Joel Fishbein | Truist Securities | Lowers | Hold | $70.00 | $75.00 |

| Gregg Moskowitz | Mizuho | Lowers | Buy | $80.00 | $85.00 |

| Ittai Kidron | Oppenheimer | Maintains | Outperform | $110.00 | - |

| Keith Bachman | BMO Capital | Lowers | Market Perform | $80.00 | $90.00 |

| Matthew Hedberg | RBC Capital | Lowers | Outperform | $95.00 | $100.00 |

| Simeon Gutman | Morgan Stanley | Lowers | Equal-Weight | $80.00 | $85.00 |

| Taz Koujalgi | Wedbush | Maintains | Outperform | $90.00 | - |

| Shaul Eyal | TD Cowen | Lowers | Market Perform | $74.00 | $100.00 |

| Andrew Nowinski | Wells Fargo | Lowers | Equal-Weight | $70.00 | $80.00 |

| Alex Henderson | Needham | Maintains | Buy | $100.00 | - |

| Adam Borg | Stifel | Maintains | Buy | $100.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Okta. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Okta compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Okta's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Okta's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Okta analyst ratings.

Get to Know Okta Better

Okta is a cloud-native security company that focuses on identity and access management. The San Francisco-based firm went public in 2017 and focuses on two key client stakeholder groups: workforces and customers. Okta's workforce offerings enable a company's employees to securely access its cloud-based and on-premises resources. The firm's customer offerings allow its clients' customers to securely access the client's applications.

Financial Milestones: Okta's Journey

Market Capitalization Analysis: The company's market capitalization surpasses industry averages, showcasing a dominant size relative to peers and suggesting a strong market position.

Revenue Growth: Okta's remarkable performance in 3 months is evident. As of 31 October, 2023, the company achieved an impressive revenue growth rate of 21.41%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Information Technology sector.

Net Margin: Okta's net margin is impressive, surpassing industry averages. With a net margin of -13.87%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Okta's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.42% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Okta's ROA excels beyond industry benchmarks, reaching -0.93%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.25, Okta adopts a prudent financial strategy, indicating a balanced approach to debt management.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.