Patterson Cos PDCO has been analyzed by 5 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

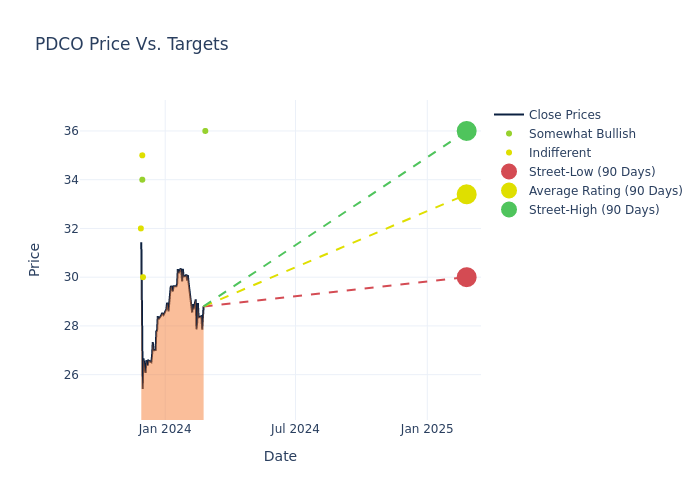

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $33.0, with a high estimate of $36.00 and a low estimate of $30.00. Highlighting a 10.2% decrease, the current average has fallen from the previous average price target of $36.75.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Patterson Cos. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Cherny | Leerink Partners | Announces | Outperform | $36.00 | - |

| Nathan Rich | Goldman Sachs | Lowers | Neutral | $30.00 | $35.00 |

| Jason Bednar | Piper Sandler | Lowers | Overweight | $34.00 | $39.00 |

| Erin Wright | Morgan Stanley | Lowers | Equal-Weight | $35.00 | $38.00 |

| Nathan Rich | Goldman Sachs | Lowers | Neutral | $30.00 | $35.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Patterson Cos. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Patterson Cos compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Patterson Cos's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Patterson Cos's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Patterson Cos analyst ratings.

Get to Know Patterson Cos Better

Patterson Companies Inc is a leading dental distributor and wholesaler of consumable products and equipment operating through two business segments, Patterson Dental, and Patterson Animal Health. The company's segment includes Dental, Animal Health, and Corporate. It generates maximum revenue from the Animal Health segment. Geographically, it derives a majority of its revenue from the United States.

Key Indicators: Patterson Cos's Financial Health

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Patterson Cos's revenue growth over a period of 3 months has been noteworthy. As of 31 October, 2023, the company achieved a revenue growth rate of approximately 1.63%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Health Care sector.

Net Margin: Patterson Cos's net margin is impressive, surpassing industry averages. With a net margin of 2.42%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Patterson Cos's ROE excels beyond industry benchmarks, reaching 3.69%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Patterson Cos's ROA stands out, surpassing industry averages. With an impressive ROA of 1.38%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Patterson Cos's debt-to-equity ratio is below the industry average at 0.72, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.