9 analysts have expressed a variety of opinions on Essex Property Trust ESS over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 5 | 1 | 1 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 1 | 1 |

| 2M Ago | 1 | 0 | 2 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

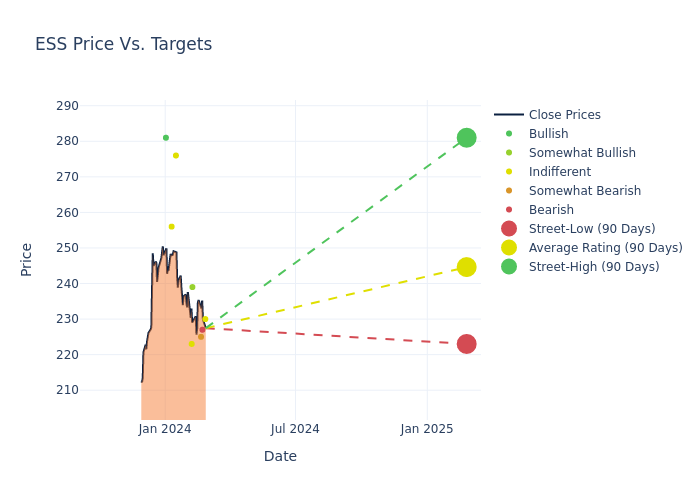

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $246.33, a high estimate of $281.00, and a low estimate of $223.00. Witnessing a positive shift, the current average has risen by 4.49% from the previous average price target of $235.75.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Essex Property Trust is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Adam Kramer | Morgan Stanley | Raises | Equal-Weight | $230.00 | $227.00 |

| Chandni Luthra | Goldman Sachs | Announces | Sell | $227.00 | - |

| Anthony Powell | Barclays | Raises | Underweight | $225.00 | $224.00 |

| Brad Heffern | RBC Capital | Raises | Outperform | $239.00 | $237.00 |

| Simon Yarmak | Stifel | Lowers | Hold | $223.00 | $225.00 |

| Michael Lewis | Truist Securities | Raises | Hold | $276.00 | $260.00 |

| Vikram Malhorta | Mizuho | Raises | Neutral | $256.00 | $232.00 |

| Linda Tsai | Jefferies | Raises | Buy | $281.00 | $215.00 |

| Michael Lewis | Truist Securities | Lowers | Hold | $260.00 | $266.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Essex Property Trust. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Essex Property Trust compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Essex Property Trust's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Essex Property Trust's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Essex Property Trust analyst ratings.

About Essex Property Trust

Essex Property Trust owns a portfolio of 252 apartment communities with over 62,000 units and is developing another property with 264 units. The company focuses on owning large, high-quality properties on the West Coast in the urban and suburban submarkets of Southern California, Northern California, and Seattle.

Essex Property Trust's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Essex Property Trust's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 0.61%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Essex Property Trust's net margin excels beyond industry benchmarks, reaching 15.5%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Essex Property Trust's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 1.19% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Essex Property Trust's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.53% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: With a below-average debt-to-equity ratio of 1.16, Essex Property Trust adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.