Omega Healthcare Invts OHI has been analyzed by 6 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

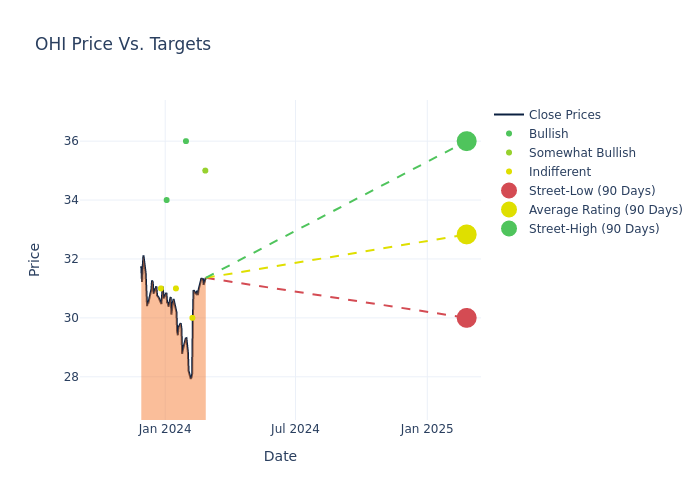

Insights from analysts' 12-month price targets are revealed, presenting an average target of $32.83, a high estimate of $36.00, and a low estimate of $30.00. This current average represents a 1.26% decrease from the previous average price target of $33.25.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Omega Healthcare Invts. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Connor Siversky | Wells Fargo | Raises | Overweight | $35.00 | $31.00 |

| Nate Crossett | Exane BNP Paribas | Announces | Neutral | $30.00 | - |

| Omotayo Okusanya | Deutsche Bank | Announces | Buy | $36.00 | - |

| Joshua Dennerlein | B of A Securities | Lowers | Neutral | $31.00 | $33.00 |

| Haendel St. Juste | Mizuho | Lowers | Buy | $34.00 | $35.00 |

| Michael Lewis | Truist Securities | Lowers | Hold | $31.00 | $34.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Omega Healthcare Invts. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Omega Healthcare Invts compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Omega Healthcare Invts's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Omega Healthcare Invts's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Omega Healthcare Invts analyst ratings.

Get to Know Omega Healthcare Invts Better

Omega Healthcare Investors Inc is a healthcare facility real estate investment trust that invests in the United States real estate markets. Omega's portfolio focuses on long-term healthcare facilities. Omega has one reportable segment consisting of investments in healthcare-related real estate properties located in the United States and the United Kingdom. Its core business is to provide financing and capital to the long-term healthcare industry with a particular focus on skilled nursing facilities (SNFs), assisted living facilities (ALFs), and to a lesser extent, independent living facilities (ILFs), rehabilitation and acute care facilities (specialty facilities) and medical office buildings (MOBs).

A Deep Dive into Omega Healthcare Invts's Financials

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Omega Healthcare Invts's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 65.22%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Real Estate sector.

Net Margin: Omega Healthcare Invts's net margin excels beyond industry benchmarks, reaching 22.98%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Omega Healthcare Invts's ROE excels beyond industry benchmarks, reaching 1.52%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.59%, the company showcases effective utilization of assets.

Debt Management: Omega Healthcare Invts's debt-to-equity ratio is below the industry average at 1.42, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.