Cencora COR has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

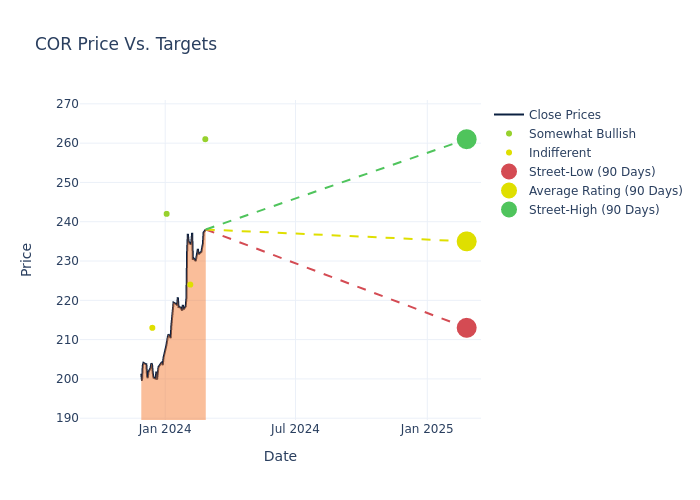

The 12-month price targets, analyzed by analysts, offer insights with an average target of $235.0, a high estimate of $261.00, and a low estimate of $213.00. This upward trend is evident, with the current average reflecting a 22.4% increase from the previous average price target of $192.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Cencora's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Cherny | Leerink Partners | Announces | Outperform | $261.00 | - |

| Omotayo Okusanya | Mizuho | Raises | Neutral | $224.00 | $192.00 |

| Stephanie Davis | Barclays | Announces | Overweight | $242.00 | - |

| Eric Luebchow | Wells Fargo | Announces | Equal-Weight | $213.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cencora. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Cencora compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Cencora's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Cencora's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Cencora analyst ratings.

All You Need to Know About Cencora

Cencora is one of three domestic leading pharmaceutical wholesalers. It sources and distributes branded, generic, and specialty pharmaceutical products to pharmacies (retail chains, independent, and mail order), hospital networks, and healthcare providers. It and McKesson and Cardinal Health constitute over 90% of the U.S. pharmaceutical wholesale industry. Cencora also provides commercialization services for manufacturers of pharmaceuticals and medical devices, global specialty drug logistics (World Courier), and animal health product distribution (MWI Animal Health). Cencora expanded its international presence in 2021 by purchasing Alliance Healthcare, one of the leading drug wholesalers in Europe.

Key Indicators: Cencora's Financial Health

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, Cencora showcased positive performance, achieving a revenue growth rate of 14.97% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Cencora's net margin is impressive, surpassing industry averages. With a net margin of 0.83%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 83.91%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Cencora's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 0.95%, the company showcases efficient use of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 5.24, caution is advised due to increased financial risk.

The Basics of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.