In the preceding three months, 6 analysts have released ratings for Utz Brands UTZ, presenting a wide array of perspectives from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 2 | 0 | 0 | 0 |

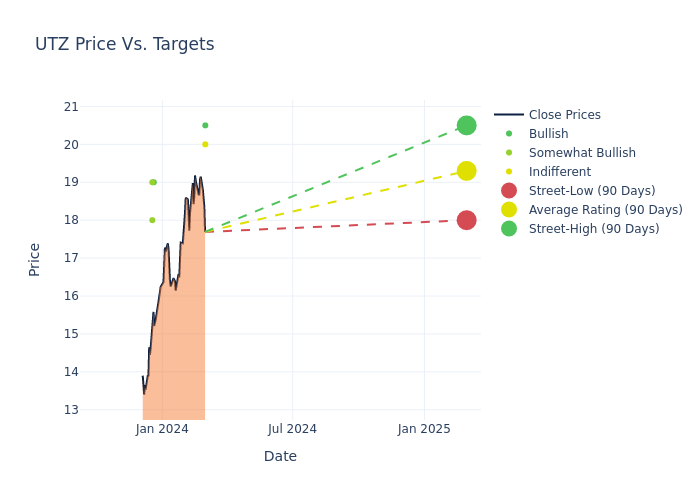

In the assessment of 12-month price targets, analysts unveil insights for Utz Brands, presenting an average target of $19.42, a high estimate of $20.50, and a low estimate of $18.00. Marking an increase of 7.89%, the current average surpasses the previous average price target of $18.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Utz Brands among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Matt McGinley | Needham | Raises | Buy | $20.50 | $20.00 |

| Brian Holland | DA Davidson | Announces | Neutral | $20.00 | - |

| Matt McGinley | Needham | Announces | Buy | $20.00 | - |

| John Baumgartner | Mizuho | Announces | Buy | $19.00 | - |

| Michael Lavery | Piper Sandler | Raises | Overweight | $18.00 | $17.00 |

| Nik Modi | RBC Capital | Raises | Outperform | $19.00 | $17.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Utz Brands. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Utz Brands compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Utz Brands's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Utz Brands's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Utz Brands analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Utz Brands

Utz Brands Inc is a snack food manufacturing company. It manufactures a diverse portfolio of salty snacks under popular brands including Utz, Zapp's, Golden Flake, Good Health, Boulder Canyon, Hawaiian, TORTIYAHS!, among others. The company's products include potato chips, pretzels, cheese snacks, pork skins, pub/party mixes, and veggie snacks. Its products are distributed nationally and internationally through grocery, mass merchant, club, convenience, drug, and other channels. It operates in the given segment: the manufacturing, distribution, marketing and sale of snack food products.

Financial Milestones: Utz Brands's Journey

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Utz Brands showcased positive performance, achieving a revenue growth rate of 2.49% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: Utz Brands's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 4.3%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Utz Brands's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.29%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Utz Brands's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.57%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.42, caution is advised due to increased financial risk.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.