Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Healthcare Realty Trust HR in the last three months.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 3 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

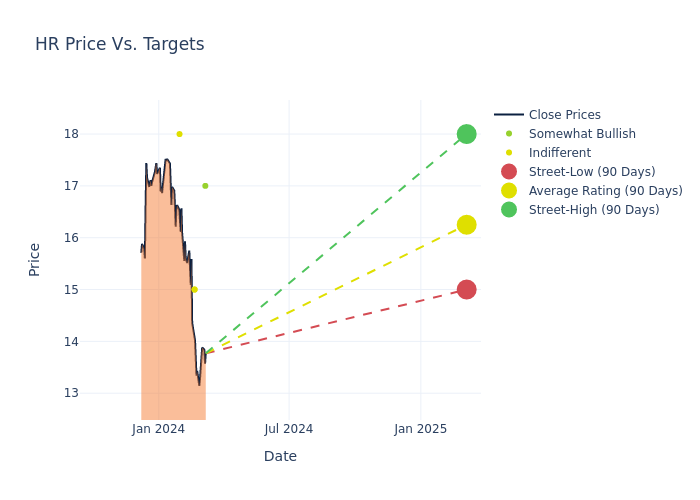

Analysts have set 12-month price targets for Healthcare Realty Trust, revealing an average target of $16.25, a high estimate of $18.00, and a low estimate of $15.00. This current average represents a 14.47% decrease from the previous average price target of $19.00.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Healthcare Realty Trust is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Michael Mueller | JP Morgan | Lowers | Overweight | $17.00 | $19.00 |

| Richard Anderson | Wedbush | Lowers | Neutral | $15.00 | $19.00 |

| Stephen Manaker | Stifel | Lowers | Hold | $15.00 | $19.00 |

| Omotayo Okusanya | Deutsche Bank | Announces | Hold | $18.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Healthcare Realty Trust. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Healthcare Realty Trust compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Healthcare Realty Trust's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Healthcare Realty Trust's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Healthcare Realty Trust analyst ratings.

All You Need to Know About Healthcare Realty Trust

Healthcare Realty Trust Inc is a healthcare facility real estate investment trust. The company focuses on owning, leasing, and managing outpatient facilities and other healthcare properties. The company considers merger and acquisition investment as a component of its operational growth strategy. It works with developers that have strong ties to a local health system and physicians. The company works to invest in outpatient facilities that are integral to a hospital's operations. It generates all of its revenue in the United States.

Breaking Down Healthcare Realty Trust's Financial Performance

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Negative Revenue Trend: Examining Healthcare Realty Trust's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -2.25% in revenue growth, reflecting a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Real Estate sector.

Net Margin: Healthcare Realty Trust's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of -12.68%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Healthcare Realty Trust's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -0.61%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Healthcare Realty Trust's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -0.33%, the company may face hurdles in achieving optimal financial returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.78.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.