In the preceding three months, 4 analysts have released ratings for Netstreit NTST, presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 1 | 1 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 1 | 1 | 0 |

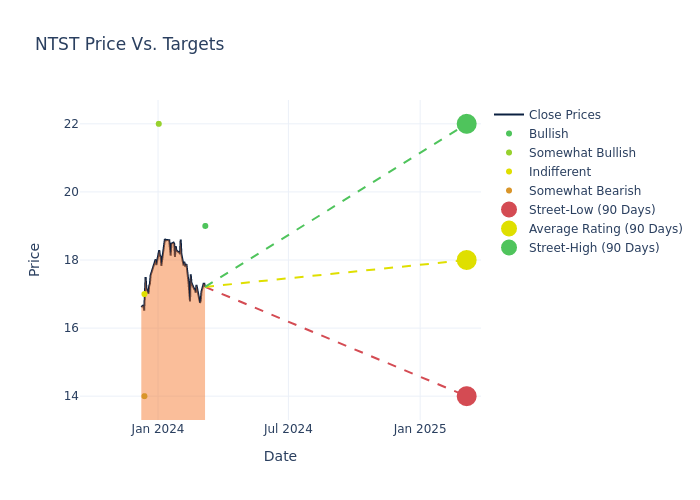

Analysts have set 12-month price targets for Netstreit, revealing an average target of $18.0, a high estimate of $22.00, and a low estimate of $14.00. Witnessing a positive shift, the current average has risen by 16.13% from the previous average price target of $15.50.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Netstreit among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Haendel St. Juste | Mizuho | Raises | Buy | $19.00 | $18.00 |

| Andrew Rosivach | Wolfe Research | Announces | Outperform | $22.00 | - |

| Nate Crossett | Exane BNP Paribas | Announces | Neutral | $17.00 | - |

| Todd Thomas | Keybanc | Raises | Underweight | $14.00 | $13.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Netstreit. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Netstreit compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Netstreit's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Netstreit's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Netstreit analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Netstreit's Background

Netstreit Corp is structured as an umbrella partnership real estate investment trust. The company acquires, owns and manages commercial single-tenant lease properties, with the majority being long-term triple-net leases where the tenant is generally responsible for all improvements and contractually obligated to pay all operating costs (such as real estate taxes, utilities and repairs and maintenance costs).

Unraveling the Financial Story of Netstreit

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Netstreit's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 30.94%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 5.65%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): Netstreit's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 0.16%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Netstreit's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.1%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Netstreit's debt-to-equity ratio is below the industry average. With a ratio of 0.51, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Analyst Ratings: What Are They?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.