Analysts' ratings for Cogent Comms Hldgs CCOI over the last quarter vary from bullish to bearish, as provided by 4 analysts.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

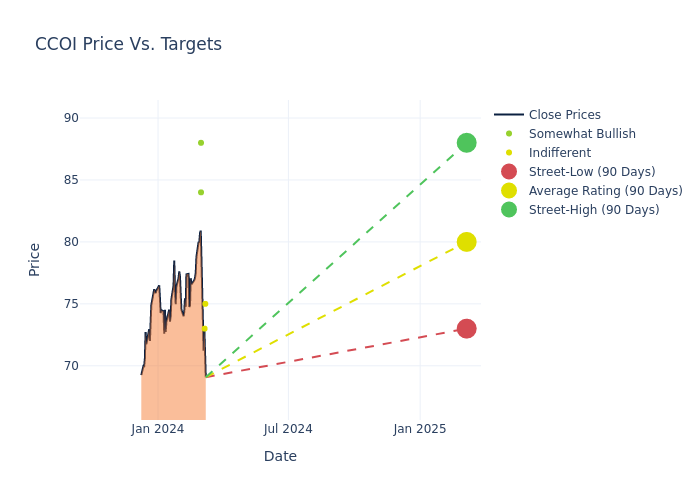

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $80.0, a high estimate of $88.00, and a low estimate of $73.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.54%.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Cogent Comms Hldgs by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| David Barden | B of A Securities | Lowers | Neutral | $75.00 | $85.00 |

| Philip Cusick | JP Morgan | Lowers | Neutral | $73.00 | $74.00 |

| Josh Beck | Keybanc | Raises | Overweight | $88.00 | $85.00 |

| Gregory Williams | TD Cowen | Raises | Outperform | $84.00 | $81.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Cogent Comms Hldgs. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Cogent Comms Hldgs compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Cogent Comms Hldgs's stock. This analysis reveals shifts in analysts' expectations over time.

To gain a panoramic view of Cogent Comms Hldgs's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Cogent Comms Hldgs analyst ratings.

All You Need to Know About Cogent Comms Hldgs

Cogent carries over one fifth of the world's internet traffic over its network and is a broadband provider for businesses. Cogent's corporate customers are in high-rise office buildings; the firm provides them with two types of connections: dedicated internet access, which connects them to the internet, and virtual private networking, which offers an internal network for employees in different locations. Cogent's corporate customers are exclusively in North America and account for over half of the firm's revenue. Cogent's netcentric customers include internet service providers and content providers, to which Cogent provides internet transit. They hand traffic to Cogent in data centers and rely on Cogent to deliver it. About half of netcentric revenue is from outside the US.

Financial Milestones: Cogent Comms Hldgs's Journey

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Cogent Comms Hldgs's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 79.04%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 73.56%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Cogent Comms Hldgs's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 38.06%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Cogent Comms Hldgs's ROA stands out, surpassing industry averages. With an impressive ROA of 6.48%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 3.0.

How Are Analyst Ratings Determined?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.