In the preceding three months, 21 analysts have released ratings for New York Community NYCB, presenting a wide array of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 1 | 17 | 3 | 0 |

| Last 30D | 0 | 0 | 3 | 0 | 0 |

| 1M Ago | 0 | 0 | 7 | 2 | 0 |

| 2M Ago | 0 | 1 | 4 | 1 | 0 |

| 3M Ago | 0 | 0 | 3 | 0 | 0 |

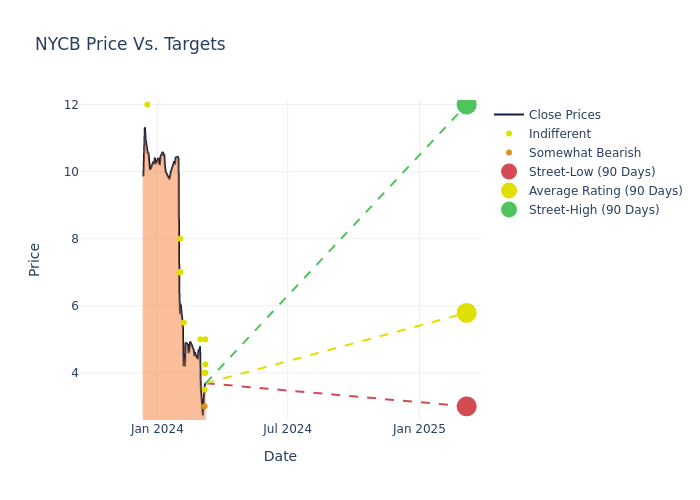

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $6.25, along with a high estimate of $12.00 and a low estimate of $3.00. A 31.47% drop is evident in the current average compared to the previous average price target of $9.12.

Deciphering Analyst Ratings: An In-Depth Analysis

A clear picture of New York Community's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Peter Winter | DA Davidson | Maintains | Neutral | $4.00 | $4.00 |

| Ebrahim Poonawala | B of A Securities | Lowers | Neutral | $4.25 | $5.00 |

| Jared Shaw | Barclays | Announces | Equal-Weight | $5.00 | - |

| Keith Horowitz | Citigroup | Lowers | Neutral | $3.50 | $5.00 |

| David Chiaverini | Wedbush | Lowers | Underperform | $3.00 | $3.50 |

| Manan Gosalia | Morgan Stanley | Lowers | Equal-Weight | $4.00 | $6.00 |

| David Chiaverini | Wedbush | Lowers | Underperform | $3.50 | $5.00 |

| Mark Fitzgibbon | Piper Sandler | Lowers | Neutral | $5.00 | $8.00 |

| Peter Winter | DA Davidson | Lowers | Neutral | $5.00 | $8.50 |

| Manan Gosalia | Morgan Stanley | Lowers | Equal-Weight | $6.00 | $7.00 |

| Ebrahim Poonawala | B of A Securities | Lowers | Neutral | $5.00 | $8.50 |

| Steven Alexopoulos | JP Morgan | Lowers | Neutral | $5.50 | $11.50 |

| David Rochester | Compass Point | Lowers | Neutral | $8.00 | $16.00 |

| Bernard von-Gizycki | Deutsche Bank | Lowers | Hold | $7.00 | $15.00 |

| Steven Duong | RBC Capital | Lowers | Sector Perform | $7.00 | $13.00 |

| Steven Alexopoulos | JP Morgan | Lowers | Overweight | $11.50 | $14.00 |

| David Chiaverini | Wedbush | Maintains | Underperform | $6.00 | - |

| Casey Haire | Jefferies | Lowers | Hold | $7.00 | $13.00 |

| David Chiaverini | Wedbush | Announces | Neutral | $8.00 | - |

| Christopher Mcgratty | Keefe, Bruyette & Woods | Announces | Market Perform | $12.00 | - |

| Keith Horowitz | Citigroup | Lowers | Neutral | $11.00 | $12.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to New York Community. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of New York Community compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of New York Community's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into New York Community's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on New York Community analyst ratings.

Get to Know New York Community Better

New York Community Bancorp Inc is the bank holding company. It is a New York State-chartered savings bank that operates through eight local divisions: Queens County Savings Bank, Roslyn Savings Bank, Richmond County Savings Bank, Roosevelt Savings Bank, and Atlantic Bank in New York; Garden State Community Bank in New Jersey; Ohio Savings Bank in Ohio, and AmTrust Bank in Florida and Arizona. The bank compete for depositors in diverse markets with a comprehensive menu of products and services, and access to multiple service channels, including online banking, mobile banking, and banking by phone. It is also a producer of multi-family loans in New York City.

New York Community: Financial Performance Dissected

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Challenges: New York Community's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -15.74%. This indicates a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: New York Community's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -29.61% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): New York Community's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -2.5%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.23%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a high debt-to-equity ratio of 2.06, New York Community faces challenges in effectively managing its debt levels, indicating potential financial strain.

The Significance of Analyst Ratings Explained

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.