Across the recent three months, 8 analysts have shared their insights on Martin Marietta Materials MLM, expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 1 | 1 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

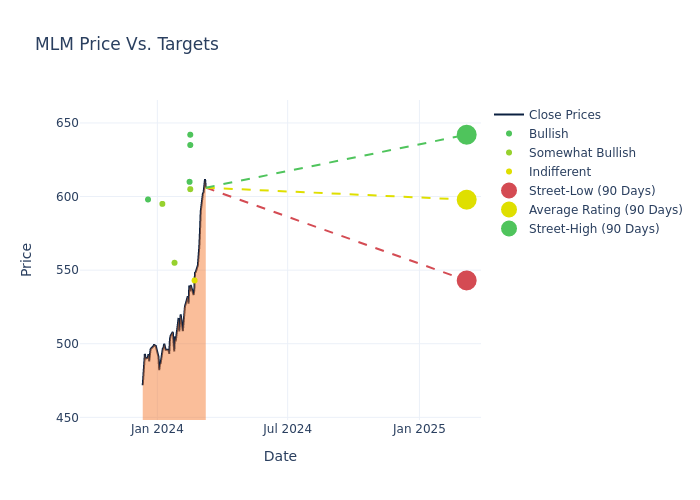

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $597.88, a high estimate of $642.00, and a low estimate of $543.00. Marking an increase of 14.69%, the current average surpasses the previous average price target of $521.29.

Deciphering Analyst Ratings: An In-Depth Analysis

The perception of Martin Marietta Materials by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Wesley Brooks | HSBC | Raises | Hold | $543.00 | $376.00 |

| Trey Grooms | Stephens & Co. | Raises | Overweight | $605.00 | $575.00 |

| Jerry Revich | Goldman Sachs | Raises | Buy | $642.00 | $560.00 |

| Anthony Pettinari | Citigroup | Raises | Buy | $635.00 | $573.00 |

| Rohit Seth | Truist Securities | Raises | Buy | $610.00 | $550.00 |

| Patrick Tyler Brown | Raymond James | Raises | Outperform | $555.00 | $505.00 |

| Angel Castillo | Morgan Stanley | Announces | Overweight | $595.00 | - |

| Stanley Elliott | Stifel | Raises | Buy | $598.00 | $510.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Martin Marietta Materials. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Martin Marietta Materials compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Martin Marietta Materials's stock. This examination reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Martin Marietta Materials's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Martin Marietta Materials analyst ratings.

Discovering Martin Marietta Materials: A Closer Look

Martin Marietta Materials is one of the United States' largest producer of construction aggregates (crushed stone, sand, and gravel). In 2023, Martin Marietta sold 199 million tons of aggregates. Martin Marietta's most important markets include Texas, Colorado, North Carolina, Georgia, and Florida, accounting for most of its sales. The company also produces cement in Texas and uses its aggregates in its asphalt and ready-mixed concrete businesses. Martin's magnesia specialties business produces magnesia-based chemical products and dolomitic lime.

Martin Marietta Materials's Financial Performance

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Martin Marietta Materials displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 8.92%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Materials sector.

Net Margin: Martin Marietta Materials's net margin is impressive, surpassing industry averages. With a net margin of 19.49%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Martin Marietta Materials's ROE stands out, surpassing industry averages. With an impressive ROE of 3.96%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Martin Marietta Materials's ROA stands out, surpassing industry averages. With an impressive ROA of 2.09%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Martin Marietta Materials's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.59, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

What Are Analyst Ratings?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.