Providing a diverse range of perspectives from bullish to bearish, 4 analysts have published ratings on Vital Farms VITL in the last three months.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 1 | 0 | 0 |

| Last 30D | 2 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

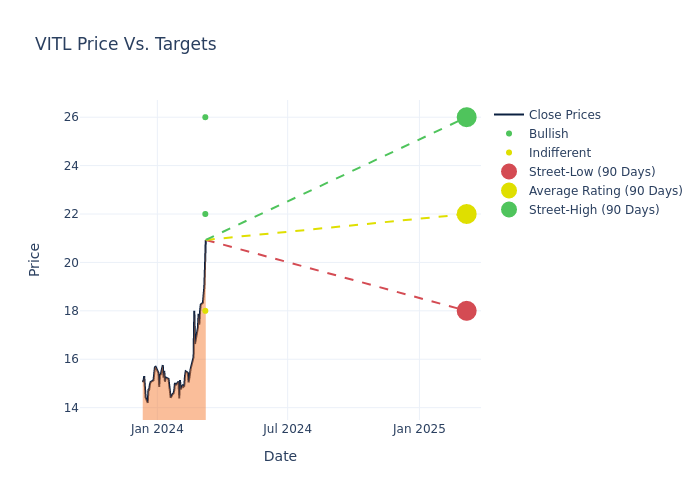

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $20.5, a high estimate of $26.00, and a low estimate of $16.00. Surpassing the previous average price target of $17.25, the current average has increased by 18.84%.

Analyzing Analyst Ratings: A Detailed Breakdown

A clear picture of Vital Farms's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ben Klieve | Lake Street | Raises | Buy | $26.00 | $22.00 |

| Matthew Smith | Stifel | Raises | Buy | $22.00 | $16.00 |

| Adam Samuelson | Goldman Sachs | Raises | Neutral | $18.00 | $16.00 |

| Matthew Smith | Stifel | Raises | Buy | $16.00 | $15.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Vital Farms. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Vital Farms compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Vital Farms's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Vital Farms's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Vital Farms analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Vital Farms's Background

Vital Farms Inc is an ethical food company. The company retails pasture-raised eggs and butter. Its products include Pasture-Raised Eggs and Pasture-Raised Butter & Ghee. The company's purpose is rooted in a commitment to Conscious Capitalism, which prioritizes the long-term benefits of each of its stakeholders (farmers and suppliers, customers and consumers, communities and the environment, employees, and stockholders).

Vital Farms's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, Vital Farms showcased positive performance, achieving a revenue growth rate of 19.98% as of 30 September, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Vital Farms's net margin excels beyond industry benchmarks, reaching 4.1%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Vital Farms's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 2.52%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Vital Farms's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.86%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.09, Vital Farms adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.