4 analysts have shared their evaluations of BRC BRCC during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 3 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

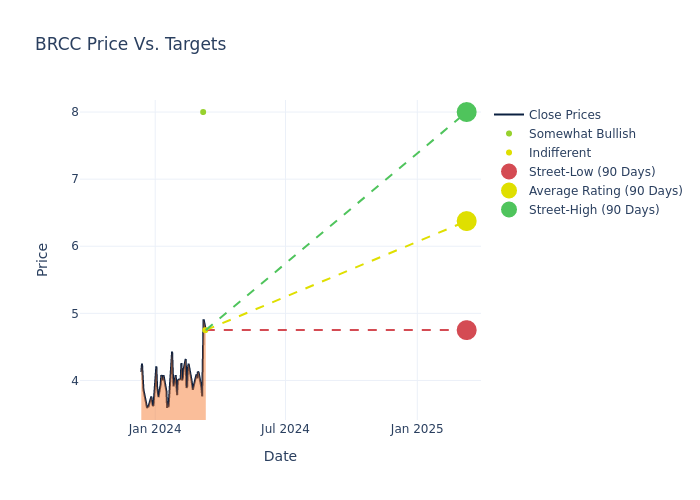

Insights from analysts' 12-month price targets are revealed, presenting an average target of $7.19, a high estimate of $8.00, and a low estimate of $4.75. Witnessing a positive shift, the current average has risen by 105.43% from the previous average price target of $3.50.

Decoding Analyst Ratings: A Detailed Look

A clear picture of BRC's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Alexandra Davis | Citigroup | Raises | Neutral | $4.75 | $3.50 |

| Sarang Vora | Telsey Advisory Group | Maintains | Outperform | $8.00 | - |

| Sarang Vora | Telsey Advisory Group | Maintains | Outperform | $8.00 | - |

| Sarang Vora | Telsey Advisory Group | Maintains | Outperform | $8.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BRC. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of BRC compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of BRC's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into BRC's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on BRC analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into BRC's Background

BRC Inc is a veteran-controlled company that serves premium coffee, content, and merchandise to active military, veterans, and first responders. it is committed to producing great coffee that consumers love, and high-quality merchandise that enables its community to showcase its brand. its omnichannel distribution has three components: Direct to Consumer channel includes its e-commerce business, through which consumers order products online and products are shipped to them, Its wholesale channel includes products sold to an intermediary such as convenience, grocery, drug, and mass merchandise stores, who in turn sell those products to consumers, and Outpost channel includes revenue from its Company-operated and franchised Black Rifle Coffee retail coffee shop locations.

Understanding the Numbers: BRC's Finances

Market Capitalization Analysis: Falling below industry benchmarks, the company's market capitalization reflects a reduced size compared to peers. This positioning may be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: BRC's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 27.81%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Consumer Staples sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of -3.75%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): BRC's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -25.81%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): BRC's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -1.89%, the company may face hurdles in achieving optimal financial returns.

Debt Management: BRC's debt-to-equity ratio stands notably higher than the industry average, reaching 8.23. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Understanding the Relevance of Analyst Ratings

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.