Across the recent three months, 7 analysts have shared their insights on Nurix Therapeutics NRIX, expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 2 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 1 | 0 | 0 |

| 2M Ago | 1 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

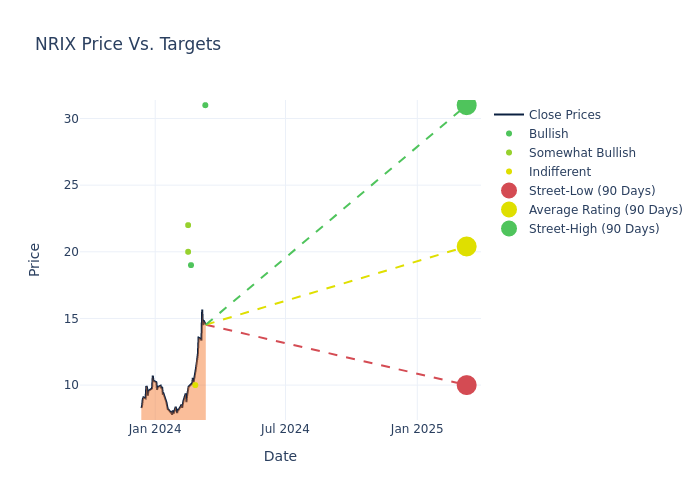

Insights from analysts' 12-month price targets are revealed, presenting an average target of $23.43, a high estimate of $31.00, and a low estimate of $10.00. Marking an increase of 2.99%, the current average surpasses the previous average price target of $22.75.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Nurix Therapeutics by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Gil Blum | Needham | Maintains | Buy | $31.00 | - |

| Terence Flynn | Morgan Stanley | Raises | Equal-Weight | $10.00 | $9.00 |

| Robert Burns | HC Wainwright & Co. | Lowers | Buy | $19.00 | $35.00 |

| Derek Archila | Wells Fargo | Lowers | Overweight | $20.00 | $23.00 |

| Gregory Renza | RBC Capital | Lowers | Outperform | $22.00 | $24.00 |

| Gil Blum | Needham | Maintains | Buy | $31.00 | - |

| Gil Blum | Needham | Maintains | Buy | $31.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Nurix Therapeutics. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of Nurix Therapeutics compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Nurix Therapeutics's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Nurix Therapeutics's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Nurix Therapeutics analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Nurix Therapeutics's Background

Nurix Therapeutics Inc is a biopharmaceutical company focused on the discovery, development and commercialization of oral, small molecule therapies designed to modulate cellular protein levels as a novel treatment approach for cancer and immune disorders. The company's pipeline comprises targeted protein degraders of Brutons tyrosine kinase, or BTK, a B-cell signaling protein, and inhibitors of Casitas B-lineage lymphoma proto-oncogene-B, or CBL-B, an E3 ligase that regulates T cell activation. Its drug candidate from protein degradation portfolio, NX-2127, is an orally available BTK degrader for the treatment of relapsed or refractory B-cell malignancies. Its drug candidate from E3 ligase inhibitor portfolio, NX-1607, is an orally available CBL-B inhibitor for immuno-oncology indications.

Financial Milestones: Nurix Therapeutics's Journey

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Nurix Therapeutics's remarkable performance in 3 months is evident. As of 30 November, 2023, the company achieved an impressive revenue growth rate of 123.49%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Health Care sector.

Net Margin: Nurix Therapeutics's net margin is impressive, surpassing industry averages. With a net margin of -276.77%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Nurix Therapeutics's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of -19.32%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Nurix Therapeutics's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -12.64%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.15.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.