Clene CLNN has been analyzed by 4 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

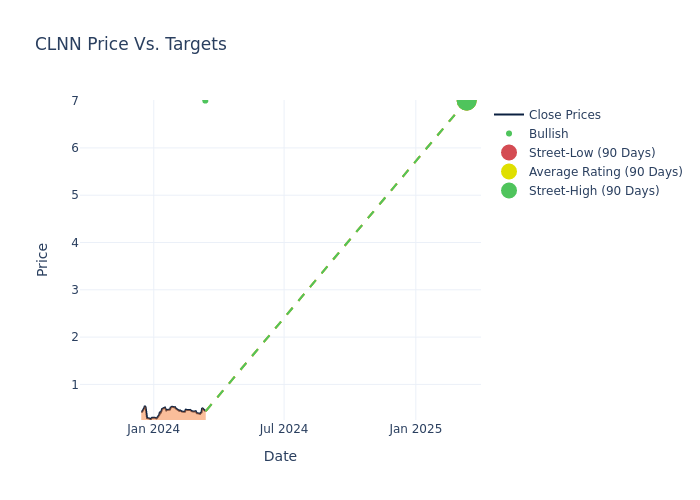

Analysts have set 12-month price targets for Clene, revealing an average target of $7.0, a high estimate of $7.00, and a low estimate of $7.00. This current average has not changed from the previous average price target.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Clene's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $7.00 | - |

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $7.00 | $7.00 |

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $7.00 | - |

| Joseph Pantginis | HC Wainwright & Co. | Maintains | Buy | $7.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Clene. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Clene compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Clene's stock. This comparison reveals trends in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Clene's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Clene analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Discovering Clene: A Closer Look

Clene Inc is a clinical-stage pharmaceutical company pioneering the discovery, development, and commercialization of novel clean-surfaced nanotechnology (CSN) therapeutics. It is focused on the development of therapeutics for neurodegenerative diseases. Its reportable segments: (1) the development and commercialization of novel clean-surfaced nanotechnology therapeutics (Drugs, and (2) the development and commercialization of dietary supplements (Supplements).

Clene: Financial Performance Dissected

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Decline in Revenue: Over the 3 months period, Clene faced challenges, resulting in a decline of approximately -37.93% in revenue growth as of 30 September, 2023. This signifies a reduction in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Clene's net margin excels beyond industry benchmarks, reaching -2238.89%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of -11.26%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Clene's ROA excels beyond industry benchmarks, reaching -3.77%. This signifies efficient management of assets and strong financial health.

Debt Management: Clene's debt-to-equity ratio surpasses industry norms, standing at 1.49. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Basics of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.