TripAdvisor TRIP underwent analysis by 11 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 0 | 8 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 2 | 0 | 4 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 1 | 0 | 0 |

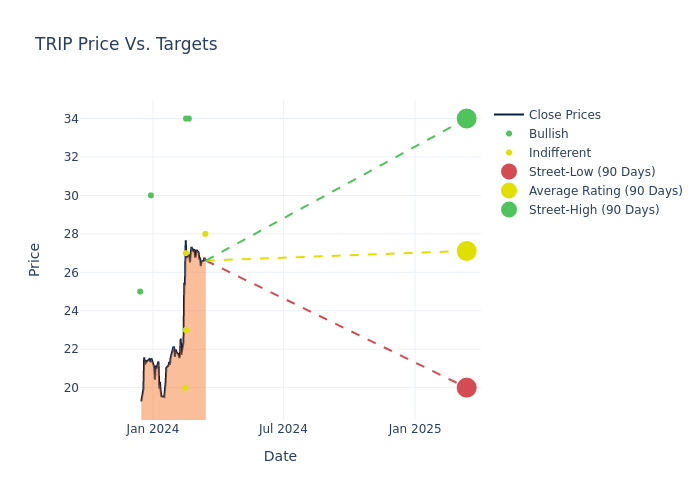

The 12-month price targets, analyzed by analysts, offer insights with an average target of $25.45, a high estimate of $34.00, and a low estimate of $20.00. This current average has increased by 19.32% from the previous average price target of $21.33.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of TripAdvisor among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Patrick Scholes | Truist Securities | Raises | Hold | $28.00 | $18.00 |

| Benjamin Miller | Goldman Sachs | Raises | Buy | $34.00 | $23.00 |

| James Lee | Mizuho | Raises | Neutral | $23.00 | $20.00 |

| Lloyd Walmsley | UBS | Raises | Neutral | $27.00 | $21.00 |

| Brian Pitz | BMO Capital | Raises | Market Perform | $23.00 | $20.00 |

| Naved Khan | B. Riley Securities | Raises | Buy | $34.00 | $27.00 |

| Scott Devitt | Wedbush | Maintains | Neutral | $20.00 | - |

| Lloyd Walmsley | UBS | Raises | Neutral | $21.00 | $18.00 |

| James Lee | Mizuho | Raises | Neutral | $20.00 | $18.00 |

| Brian Pitz | BMO Capital | Announces | Market Perform | $20.00 | - |

| Edward Woo | Ascendiant Capital | Raises | Buy | $30.00 | $27.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to TripAdvisor. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of TripAdvisor compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for TripAdvisor's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of TripAdvisor's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on TripAdvisor analyst ratings.

Unveiling the Story Behind TripAdvisor

Tripadvisor is the world's leading travel metasearch company. Its platform offers 1 billion reviews and information on about 8 million accommodations, restaurants, experiences, airlines, and cruises. In 2023, 58% of revenue came from the company's core Brand Tripadvisor segment, which includes hotel revenue generated through advertising on its metasearch platform. Viator, its experiences brand, was 41% of sales in 2023, and TheFork, its dining brand, represented 9% of revenue (about 8% of sales were intersegment, which are eliminated from consolidated revenue).

TripAdvisor: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: TripAdvisor displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 10.17%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: TripAdvisor's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 8.21% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): TripAdvisor's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 3.78%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): TripAdvisor's ROA stands out, surpassing industry averages. With an impressive ROA of 1.24%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a high debt-to-equity ratio of 1.05, TripAdvisor faces challenges in effectively managing its debt levels, indicating potential financial strain.

Analyst Ratings: Simplified

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.