Across the recent three months, 7 analysts have shared their insights on Sysco SYY, expressing a variety of opinions spanning from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 5 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 3 | 0 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

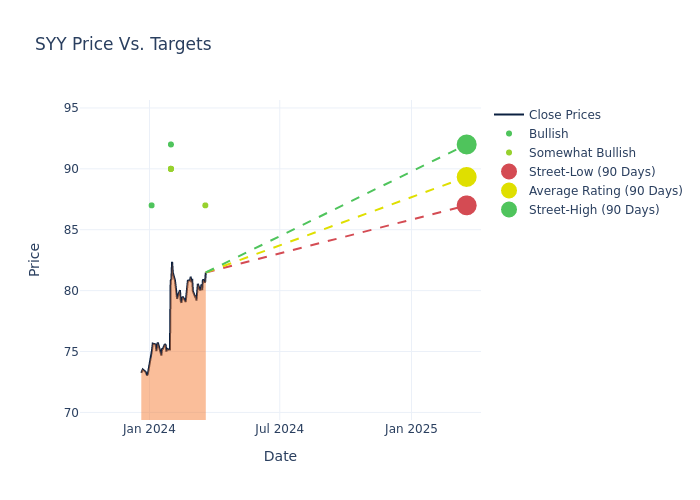

In the assessment of 12-month price targets, analysts unveil insights for Sysco, presenting an average target of $88.71, a high estimate of $92.00, and a low estimate of $85.00. Observing a 6.88% increase, the current average has risen from the previous average price target of $83.00.

Investigating Analyst Ratings: An Elaborate Study

In examining recent analyst actions, we gain insights into how financial experts perceive Sysco. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Ivankoe | JP Morgan | Raises | Overweight | $87.00 | $84.00 |

| Mark Carden | UBS | Raises | Buy | $92.00 | $83.00 |

| Joshua Long | Stephens & Co. | Raises | Overweight | $90.00 | $80.00 |

| Kelly Bania | BMO Capital | Raises | Outperform | $90.00 | $85.00 |

| Jeffrey Bernstein | Barclays | Raises | Overweight | $90.00 | $85.00 |

| Jake Bartlett | Truist Securities | Maintains | Buy | $87.00 | $87.00 |

| Jeffrey Bernstein | Barclays | Raises | Overweight | $85.00 | $77.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Sysco. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Sysco compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Sysco's stock. This analysis reveals shifts in analysts' expectations over time.

For valuable insights into Sysco's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Sysco analyst ratings.

Discovering Sysco: A Closer Look

Sysco is the largest U.S. foodservice distributor with 17% share of the highly fragmented $350 billion domestic market. Sysco distributes roughly 500,000 food and nonfood products to restaurants (62% of fiscal 2023 revenue), education and government buildings (8%), travel and leisure (8%), healthcare facilities (7%) and other locations (15%) where individuals consume away-from-home meals. In fiscal 2023, 70% of the firm's revenue was derived from its U.S. foodservice operations, while its international (18%), quick-service logistics (10%), and other (2%) segments made up the difference.

Sysco's Economic Impact: An Analysis

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Sysco displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 3.73%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Sysco's net margin is impressive, surpassing industry averages. With a net margin of 2.15%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Sysco's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 18.33% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Sysco's ROA stands out, surpassing industry averages. With an impressive ROA of 1.73%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Sysco's debt-to-equity ratio stands notably higher than the industry average, reaching 5.39. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

The Core of Analyst Ratings: What Every Investor Should Know

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.