12 analysts have shared their evaluations of Morgan Stanley MS during the recent three months, expressing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 6 | 5 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 4 | 5 | 0 | 0 |

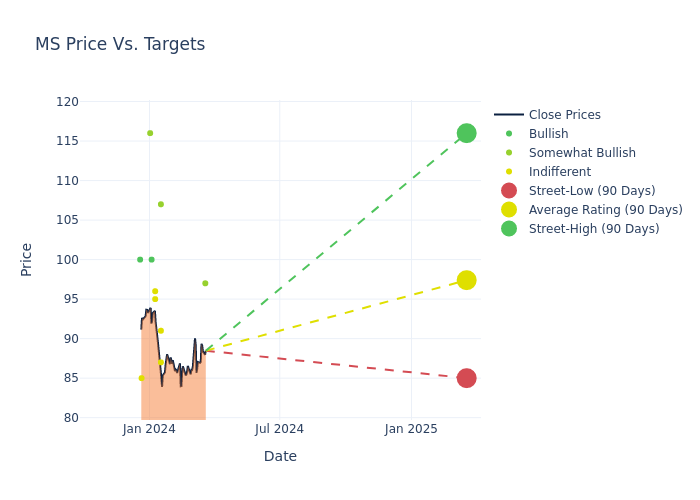

Analysts have recently evaluated Morgan Stanley and provided 12-month price targets. The average target is $98.58, accompanied by a high estimate of $116.00 and a low estimate of $85.00. A 0.73% drop is evident in the current average compared to the previous average price target of $99.30.

Interpreting Analyst Ratings: A Closer Look

The perception of Morgan Stanley by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Chris Kotowski | Oppenheimer | Lowers | Outperform | $97.00 | $109.00 |

| Chris Kotowski | Oppenheimer | Raises | Outperform | $109.00 | $106.00 |

| Chris Kotowski | Oppenheimer | Lowers | Outperform | $106.00 | $107.00 |

| James Fotheringham | BMO Capital | Raises | Outperform | $107.00 | $106.00 |

| David Konrad | Keefe, Bruyette & Woods | Lowers | Market Perform | $91.00 | $102.00 |

| Kian Abouhossein | JP Morgan | Lowers | Neutral | $87.00 | $94.00 |

| Brennan Hawken | UBS | Raises | Neutral | $95.00 | $80.00 |

| Kian Abouhossein | JP Morgan | Raises | Overweight | $94.00 | $92.00 |

| Saul Martinez | HSBC | Announces | Hold | $96.00 | - |

| Michael Carrier | B of A Securities | Raises | Buy | $100.00 | $95.00 |

| Jason Goldberg | Barclays | Raises | Overweight | $116.00 | $102.00 |

| Gerard Cassidy | RBC Capital | Maintains | Sector Perform | $85.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Morgan Stanley. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Morgan Stanley compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Morgan Stanley's stock. This examination reveals shifts in analysts' expectations over time.

To gain a panoramic view of Morgan Stanley's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Morgan Stanley analyst ratings.

All You Need to Know About Morgan Stanley

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments. The company had over $4 trillion of client assets as well as over 80,000 employees at the end of 2022. Approximately 50% of the company's net revenue is from its institutional securities business, with the remainder coming from wealth and investment management. The company derives about 30% of its total revenue outside the Americas.

Financial Milestones: Morgan Stanley's Journey

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: Morgan Stanley's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 1.12%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Financials sector.

Net Margin: Morgan Stanley's net margin excels beyond industry benchmarks, reaching 11.5%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Morgan Stanley's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 1.53%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Morgan Stanley's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.12%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Morgan Stanley's debt-to-equity ratio stands notably higher than the industry average, reaching 3.06. This indicates a heavier reliance on borrowed funds, raising concerns about financial leverage.

Analyst Ratings: What Are They?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.