Throughout the last three months, 4 analysts have evaluated Iteris ITI, offering a diverse set of opinions from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

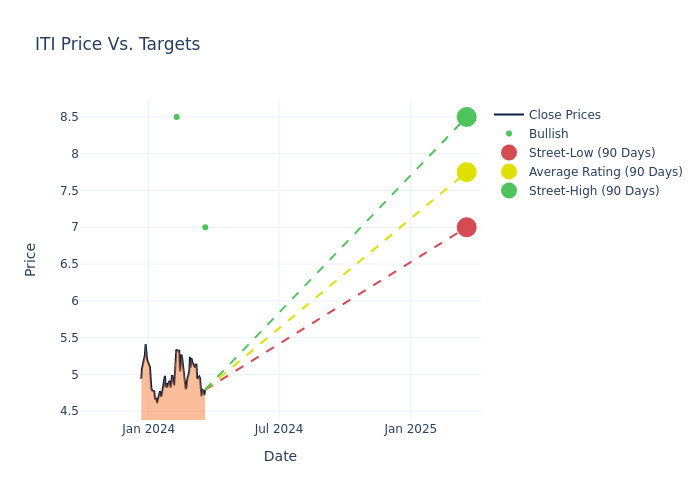

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $7.38, along with a high estimate of $8.50 and a low estimate of $7.00. This current average has increased by 16.59% from the previous average price target of $6.33.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Iteris's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tim Moore | EF Hutton | Maintains | Buy | $7.00 | - |

| Tim Moore | EF Hutton | Maintains | Buy | $7.00 | $7.00 |

| Tim Moore | EF Hutton | Raises | Buy | $7.00 | $6.00 |

| Jeff Van Sinderen | B. Riley Securities | Raises | Buy | $8.50 | $6.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Iteris. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Iteris compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Iteris's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Iteris's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Iteris analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Iteris

Iteris Inc is a provider of smart mobility infrastructure management solutions. Its solutions include traveler information systems, transportation performance measurement software, traffic analytics software, transportation operations software, transportation-related data sets, advanced sensing devices, managed services, traffic engineering services, and mobility consulting services. The company's cloud-enabled end-to-end solutions help public transportation agencies, municipalities, commercial entities and other transportation infrastructure providers monitor, visualize, and optimize mobility infrastructure to make mobility safe, efficient,and sustainable for everyone. The software solutions include ClearGuide, ClearRoute, Commercial Vehicle Operations, BlueArgus, TrafficCarma,and others.

Unraveling the Financial Story of Iteris

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Iteris's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 3.55%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 0.84%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Iteris's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 0.52% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Iteris's ROA excels beyond industry benchmarks, reaching 0.3%. This signifies efficient management of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.09, Iteris adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.