In the last three months, 15 analysts have published ratings on Shake Shack SHAK, offering a diverse range of perspectives from bullish to bearish.

The table below summarizes their recent ratings, showcasing the evolving sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 6 | 1 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 1 | 0 |

| 2M Ago | 2 | 1 | 6 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

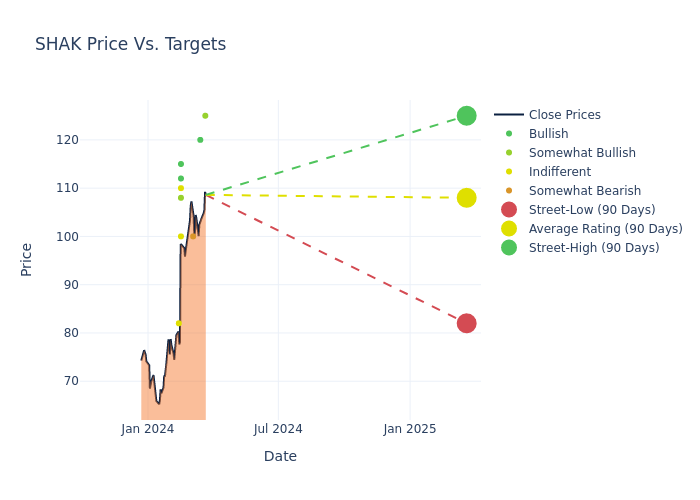

Analysts have recently evaluated Shake Shack and provided 12-month price targets. The average target is $101.53, accompanied by a high estimate of $125.00 and a low estimate of $80.00. This upward trend is evident, with the current average reflecting a 23.25% increase from the previous average price target of $82.38.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Shake Shack among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Andrew Charles | TD Cowen | Maintains | Outperform | $125.00 | - |

| Peter Saleh | BTIG | Raises | Buy | $120.00 | $110.00 |

| Andrew Charles | TD Cowen | Raises | Outperform | $125.00 | $91.00 |

| John Ivankoe | JP Morgan | Raises | Underweight | $100.00 | $65.00 |

| Dennis Geiger | UBS | Raises | Neutral | $110.00 | $88.00 |

| Brian Vaccaro | Raymond James | Raises | Strong Buy | $115.00 | $90.00 |

| Michael Tamas | Oppenheimer | Raises | Outperform | $108.00 | $80.00 |

| Jake Bartlett | Truist Securities | Raises | Buy | $112.00 | $90.00 |

| Nick Setyan | Wedbush | Raises | Neutral | $100.00 | $80.00 |

| Andrew Charles | TD Cowen | Raises | Market Perform | $91.00 | $73.00 |

| Nick Setyan | Wedbush | Maintains | Neutral | $80.00 | - |

| David Tarantino | Baird | Raises | Neutral | $82.00 | $67.00 |

| Dennis Geiger | UBS | Raises | Neutral | $88.00 | $80.00 |

| Jake Bartlett | Truist Securities | Maintains | Buy | $87.00 | $87.00 |

| Michael Tamas | Oppenheimer | Raises | Outperform | $80.00 | $70.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Shake Shack. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Shake Shack compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Shake Shack's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Shake Shack's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Shake Shack analyst ratings.

Delving into Shake Shack's Background

Shake Shack Inc is a roadside burger stand. It is serving a classic American menu of premium burgers, hot dogs, crispy chicken, frozen custard, crinkle-cut fries, shakes, beer, wine and more. The company's burgers are made with a whole-muscle blend of all-natural, hormone and antibiotic-free Angus beef, ground fresh daily, cooked to order and served on a non-genetically modified organism (GMO) potato bun. Its menu focuses on food and beverages, crafted from a range of classic American foods. The company serves draft Root Beer, seasonal freshly-squeezed lemonade, organic fresh brewed iced tea, cold brew coffee, organic apple juice, and Shack20 bottled water.

A Deep Dive into Shake Shack's Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Growth: Shake Shack's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 20.0%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Shake Shack's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.52% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Shake Shack's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 1.68%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.46%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 1.74, Shake Shack adopts a prudent financial strategy, indicating a balanced approach to debt management.

Understanding the Relevance of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.