During the last three months, 13 analysts shared their evaluations of Permian Resources PR, revealing diverse outlooks from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 5 | 2 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 4 | 3 | 1 | 0 | 0 |

| 2M Ago | 1 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

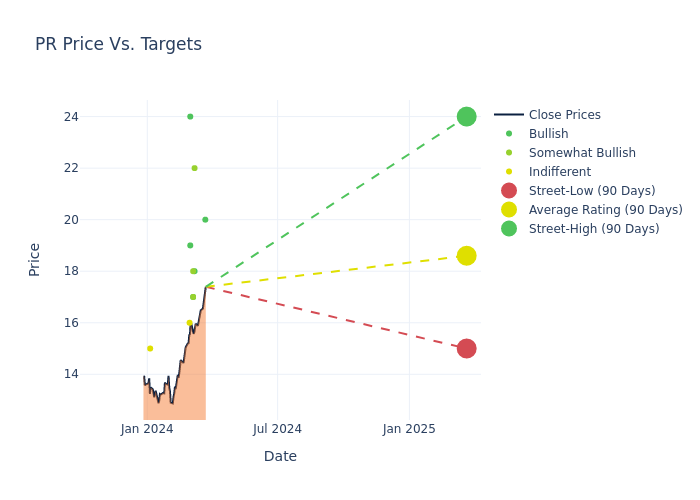

Analysts have set 12-month price targets for Permian Resources, revealing an average target of $18.69, a high estimate of $24.00, and a low estimate of $15.00. This current average has increased by 3.83% from the previous average price target of $18.00.

Analyzing Analyst Ratings: A Detailed Breakdown

A comprehensive examination of how financial experts perceive Permian Resources is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Derrick Whitfield | Stifel | Raises | Buy | $20.00 | $18.00 |

| Nitin Kumar | Mizuho | Raises | Buy | $18.00 | $16.00 |

| Mark Lear | Piper Sandler | Raises | Overweight | $22.00 | $17.00 |

| Scott Hanold | RBC Capital | Maintains | Outperform | $17.00 | - |

| Subash Chandra | Benchmark | Raises | Buy | $17.00 | $16.00 |

| Hanwen Chang | Wells Fargo | Raises | Overweight | $18.00 | $17.00 |

| Paul Diamond | Citigroup | Raises | Buy | $19.00 | $17.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $24.00 | $23.00 |

| Biju Perincheril | Susquehanna | Raises | Neutral | $16.00 | $15.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $23.00 | $22.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $17.00 | $19.00 |

| Scott Hanold | RBC Capital | Maintains | Outperform | $17.00 | - |

| Doug Leggate | B of A Securities | Announces | Neutral | $15.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Permian Resources. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Permian Resources compared to the broader market.

- Price Targets: Delving into movements, analysts provide estimates for the future value of Permian Resources's stock. This analysis reveals shifts in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Permian Resources's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Permian Resources analyst ratings.

Get to Know Permian Resources Better

Permian Resources Corp is an independent oil and natural gas company focused on generating outsized returns to stakeholders through the responsible acquisition, optimization and development of oil and liquids-rich natural gas assets. The Company's assets and operations are primarily concentrated in the core of the Permian Basin, and its properties consist of large, contiguous acreage blocks located in West Texas and New Mexico.

Permian Resources's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Permian Resources showcased positive performance, achieving a revenue growth rate of 47.42% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Permian Resources's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 22.86%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Permian Resources's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 5.14%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Permian Resources's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 2.12%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Permian Resources's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.62, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.