In the preceding three months, 8 analysts have released ratings for Penumbra PEN, presenting a wide array of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 2 | 2 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

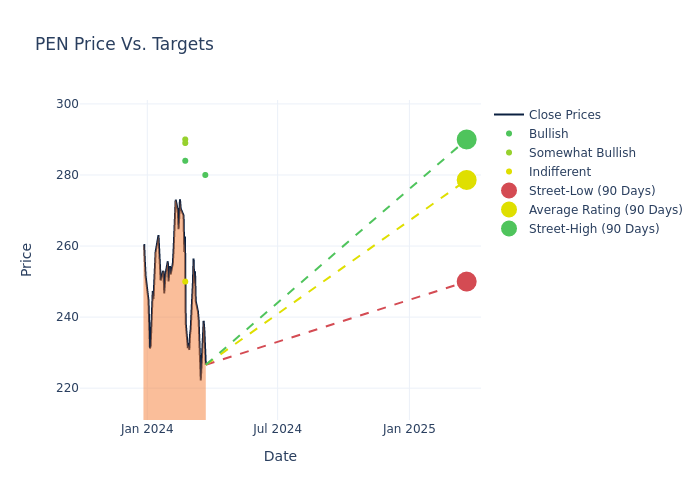

Analysts have set 12-month price targets for Penumbra, revealing an average target of $281.5, a high estimate of $290.00, and a low estimate of $250.00. A negative shift in sentiment is evident as analysts have decreased the average price target by 1.34%.

Diving into Analyst Ratings: An In-Depth Exploration

An in-depth analysis of recent analyst actions unveils how financial experts perceive Penumbra. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Richard Newitter | Truist Securities | Lowers | Buy | $280.00 | $290.00 |

| Matt O'Brien | Piper Sandler | Lowers | Overweight | $290.00 | $310.00 |

| Shagun Singh | RBC Capital | Maintains | Outperform | $289.00 | - |

| William Plovanic | Canaccord Genuity | Maintains | Buy | $284.00 | - |

| David Rescott | Truist Securities | Lowers | Buy | $290.00 | $300.00 |

| Robbie Marcus | JP Morgan | Lowers | Neutral | $250.00 | $284.00 |

| Shagun Singh | RBC Capital | Raises | Outperform | $289.00 | $280.00 |

| Shagun Singh | RBC Capital | Raises | Outperform | $280.00 | $248.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Penumbra. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Penumbra compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Penumbra's stock. This examination reveals shifts in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Penumbra's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Penumbra analyst ratings.

Delving into Penumbra's Background

Penumbra Inc develops and manufactures medical devices for the neurovascular and peripheral vascular markets. Its products are sold to hospitals and are developed for use by specialist physicians. The neurovascular product category contributes to the majority of revenue. Within the neurovascular business, the firm offers products for neurovascular access, ischemic stroke, neurovascular embolization, and neurosurgical tool markets. In the peripheral vascular business, the firm sells devices related to peripheral embolization and peripheral thrombectomy. Penumbra generates the majority of its revenue in the United States.

A Deep Dive into Penumbra's Financials

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Penumbra's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 28.69%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Health Care sector.

Net Margin: Penumbra's net margin excels beyond industry benchmarks, reaching 19.05%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Penumbra's ROE stands out, surpassing industry averages. With an impressive ROE of 4.75%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Penumbra's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 3.58%, the company showcases efficient use of assets and strong financial health.

Debt Management: With a below-average debt-to-equity ratio of 0.2, Penumbra adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.