13 analysts have expressed a variety of opinions on Verizon Communications VZ over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 6 | 5 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 4 | 4 | 0 | 0 |

| 3M Ago | 0 | 2 | 0 | 0 | 0 |

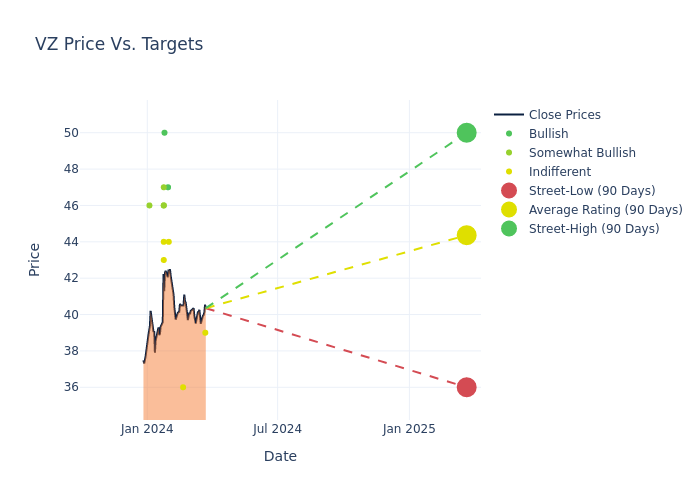

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $44.38, a high estimate of $50.00, and a low estimate of $36.00. Marking an increase of 7.25%, the current average surpasses the previous average price target of $41.38.

Diving into Analyst Ratings: An In-Depth Exploration

The standing of Verizon Communications among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Steve Malcolm | Redburn Atlantic | Announces | Neutral | $39.00 | - |

| Jonathan Atkin | RBC Capital | Raises | Sector Perform | $36.00 | $35.00 |

| Kannan Venkateshwar | Barclays | Announces | Equal-Weight | $44.00 | - |

| Michael Rollins | Citigroup | Raises | Buy | $47.00 | $45.00 |

| Kannan Venkateshwar | Barclays | Raises | Overweight | $44.00 | $42.00 |

| Ivan Feinseth | Tigress Financial | Raises | Buy | $50.00 | $45.00 |

| John Hodulik | UBS | Raises | Neutral | $43.00 | $37.00 |

| Eric Luebchow | Wells Fargo | Raises | Equal-Weight | $44.00 | $40.00 |

| Frank Louthan | Raymond James | Raises | Outperform | $46.00 | $42.00 |

| Jonathan Kees | Daiwa Capital | Announces | Outperform | $47.00 | - |

| Brandon Nispel | Keybanc | Raises | Overweight | $46.00 | $45.00 |

| Peter Supino | Wolfe Research | Announces | Outperform | $46.00 | - |

| Brandon Nispel | Keybanc | Announces | Overweight | $45.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Verizon Communications. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Verizon Communications compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

To gain a panoramic view of Verizon Communications's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Verizon Communications analyst ratings.

Discovering Verizon Communications: A Closer Look

Wireless services account for about 70% of Verizon Communications' total service revenue and nearly all of its operating income. The firm serves about 93 million postpaid and 21 million prepaid phone customers (following the acquisition of Tracfone) via its nationwide network, making it the largest U.S. wireless carrier. Fixed-line telecom operations include local networks in the Northeast, which reach about 25 million homes and businesses and serve about 8 million broadband customers. Verizon also provides telecom services nationwide to enterprise customers, often using a mixture of its own and other carriers' networks.

Verizon Communications: Delving into Financials

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Verizon Communications's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -0.34%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Communication Services sector.

Net Margin: Verizon Communications's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of -7.7%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Verizon Communications's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -2.84% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -0.71%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Verizon Communications's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.89.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.