Across the recent three months, 15 analysts have shared their insights on Super Micro Computer SMCI, expressing a variety of opinions spanning from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 4 | 1 | 0 |

| Last 30D | 0 | 2 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 1 | 0 | 0 |

| 2M Ago | 3 | 2 | 2 | 1 | 0 |

| 3M Ago | 0 | 1 | 1 | 0 | 0 |

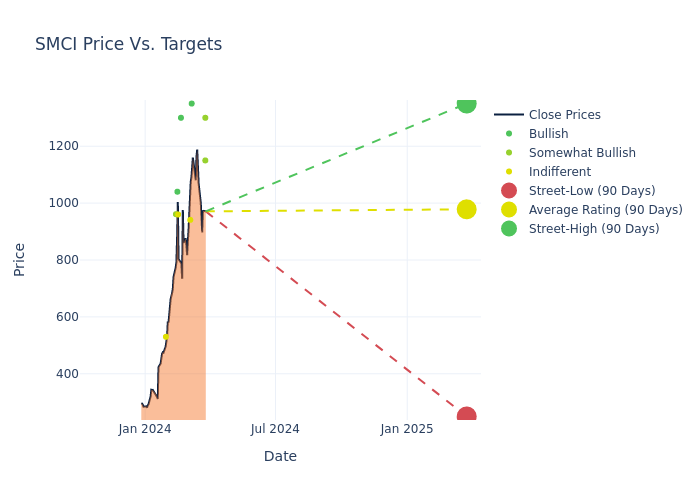

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $868.87, a high estimate of $1350.00, and a low estimate of $250.00. This upward trend is evident, with the current average reflecting a 53.24% increase from the previous average price target of $567.00.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive Super Micro Computer. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nehal Chokshi | Northland Capital Markets | Raises | Outperform | $1300.00 | $925.00 |

| Samik Chatterjee | JP Morgan | Announces | Overweight | $1150.00 | - |

| Ruplu Bhattacharya | B of A Securities | Raises | Buy | $1280.00 | $1040.00 |

| Jim Kelleher | Argus Research | Announces | Buy | $1350.00 | - |

| Michael Ng | Goldman Sachs | Announces | Neutral | $941.00 | - |

| Hans Mosesmann | Rosenblatt | Raises | Buy | $1300.00 | $700.00 |

| Aaron Rakers | Wells Fargo | Announces | Equal-Weight | $960.00 | - |

| Ruplu Bhattacharya | B of A Securities | Announces | Buy | $1040.00 | - |

| George Wang | Barclays | Raises | Overweight | $961.00 | $691.00 |

| Hans Mosesmann | Rosenblatt | Raises | Buy | $700.00 | $550.00 |

| Matt Bryson | Wedbush | Raises | Neutral | $530.00 | $250.00 |

| Nehal Chokshi | Northland Capital Markets | Raises | Outperform | $625.00 | $450.00 |

| Mehdi Hosseini | Susquehanna | Raises | Negative | $250.00 | $162.00 |

| Matt Bryson | Wedbush | Maintains | Neutral | $250.00 | - |

| George Wang | Barclays | Raises | Overweight | $396.00 | $335.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Super Micro Computer. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Super Micro Computer compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Super Micro Computer's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Super Micro Computer analyst ratings.

About Super Micro Computer

Super Micro Computer Inc provides high-performance server technology services to cloud computing, data center, Big Data, high-performance computing, and "Internet of Things" embedded markets. Its solutions include server, storage, blade and workstations to full racks, networking devices, and server management software. The firm follows a modular architectural approach, which provides flexibility to deliver customized solutions. The Company operates in one operating segment that develops and provides high-performance server solutions based upon an innovative, modular and open-standard architecture. More than half of the firm's revenue is generated in the United States, with the rest coming from Europe, Asia, and other regions.

Unraveling the Financial Story of Super Micro Computer

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Over the 3 months period, Super Micro Computer showcased positive performance, achieving a revenue growth rate of 103.25% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Information Technology sector.

Net Margin: Super Micro Computer's net margin excels beyond industry benchmarks, reaching 8.08%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 11.29%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Super Micro Computer's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.23% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: Super Micro Computer's debt-to-equity ratio is below the industry average at 0.12, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.