Across the recent three months, 5 analysts have shared their insights on Brixmor Property Group BRX, expressing a variety of opinions spanning from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 3 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

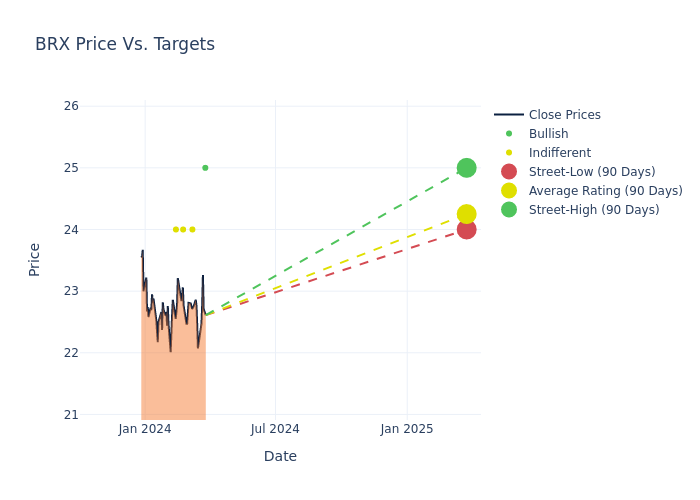

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $24.0, a high estimate of $25.00, and a low estimate of $23.00. This current average has increased by 5.77% from the previous average price target of $22.69.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Brixmor Property Group is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ki Bin Kim | Truist Securities | Maintains | Buy | $25.00 | - |

| Linda Tsai | Jefferies | Raises | Hold | $24.00 | $23.00 |

| Vikram Malhotra | Mizuho | Raises | Neutral | $24.00 | $23.00 |

| Simon Yarmak | Stifel | Raises | Hold | $24.00 | $22.75 |

| Vikram Malhotra | Mizuho | Raises | Buy | $23.00 | $22.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Brixmor Property Group. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Brixmor Property Group compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Brixmor Property Group's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Brixmor Property Group's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Brixmor Property Group analyst ratings.

Unveiling the Story Behind Brixmor Property Group

Brixmor Property Group Inc is a real estate investment trust based in the United States. The company owns and operates a portfolio of grocery-anchored community and neighborhood shopping centers across the United States. It leases its rentable areas to retailers, restaurants, theatres, entertainment venues, and fitness centers, with the company's tenants consisting of large department stores, discount retailers, and grocery stores. The company is an internally managed REIT. The company operates in Florida, Texas, California, New York, Pennsylvania, Illinois, New Jersey, Georgia, North Carolina, Michigan, Ohio and other states.

Financial Milestones: Brixmor Property Group's Journey

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Brixmor Property Group's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 2.57%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Real Estate sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Brixmor Property Group's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 22.9%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Brixmor Property Group's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.54%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Brixmor Property Group's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of 0.87%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: Brixmor Property Group's debt-to-equity ratio is below the industry average. With a ratio of 1.73, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.