In the last three months, 5 analysts have published ratings on Enterprise Prods Partners EPD, offering a diverse range of perspectives from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 0 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

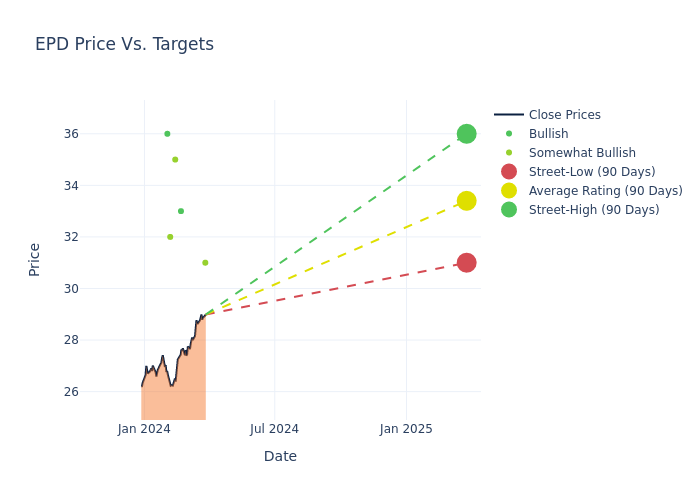

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $33.4, a high estimate of $36.00, and a low estimate of $31.00. This upward trend is apparent, with the current average reflecting a 5.2% increase from the previous average price target of $31.75.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Enterprise Prods Partners's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Theresa Chen | Barclays | Raises | Overweight | $31.00 | $30.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $33.00 | $31.00 |

| Elvira Scotto | RBC Capital | Maintains | Outperform | $35.00 | - |

| Michael Blum | Wells Fargo | Raises | Overweight | $32.00 | $31.00 |

| Selman Akyol | Stifel | Raises | Buy | $36.00 | $35.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Enterprise Prods Partners. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Enterprise Prods Partners compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Enterprise Prods Partners's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

For valuable insights into Enterprise Prods Partners's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Enterprise Prods Partners analyst ratings.

Unveiling the Story Behind Enterprise Prods Partners

Enterprise Products Partners is a master limited partnership that transports and processes natural gas, natural gas liquids, crude oil, refined products, and petrochemicals. It is one of the largest midstream companies, with operations servicing most producing regions in the Lower 48 states. Enterprise is particularly dominant in the NGL market and is one of the few MLPs that provide midstream services across the full hydrocarbon value chain.

Breaking Down Enterprise Prods Partners's Financial Performance

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Enterprise Prods Partners's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 7.12%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Energy sector.

Net Margin: Enterprise Prods Partners's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 10.38%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Enterprise Prods Partners's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 5.54%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Enterprise Prods Partners's ROA stands out, surpassing industry averages. With an impressive ROA of 2.16%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: With a below-average debt-to-equity ratio of 1.05, Enterprise Prods Partners adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.