Ratings for Hilton Grand Vacations HGV were provided by 6 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

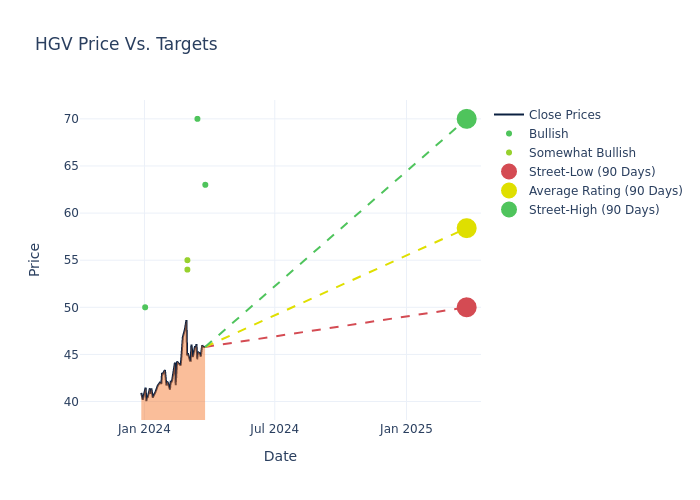

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $57.83, with a high estimate of $70.00 and a low estimate of $50.00. This upward trend is evident, with the current average reflecting a 14.13% increase from the previous average price target of $50.67.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Hilton Grand Vacations by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Ben Chaiken | Mizuho | Announces | Buy | $63.00 | - |

| Patrick Scholes | Truist Securities | Raises | Buy | $70.00 | $66.00 |

| Aaron Hecht | JMP Securities | Maintains | Market Outperform | $55.00 | - |

| Brandt Montour | Barclays | Raises | Overweight | $54.00 | $47.00 |

| Aaron Hecht | JMP Securities | Announces | Market Outperform | $55.00 | - |

| David Katz | Jefferies | Raises | Buy | $50.00 | $39.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Hilton Grand Vacations. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts unravel qualitative evaluations for stocks, ranging from 'Outperform' to 'Underperform'. These ratings offer insights into expectations for the relative performance of Hilton Grand Vacations compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Hilton Grand Vacations's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Hilton Grand Vacations's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Hilton Grand Vacations analyst ratings.

Discovering Hilton Grand Vacations: A Closer Look

Hilton Grand Vacations Inc is a timeshare company engaged in developing, marketing, selling, managing, and operating timeshare resorts, timeshare plans, and ancillary reservation services, under the Hilton Grand Vacations brand. The company operates business in the following two segments: (i) Real estate sales and financing and (ii) Resort operations and club management. The majority of the company's revenue is earned through the Real estate sales and financing segment, which generates revenue from VOI sales, and Financing.

Hilton Grand Vacations's Economic Impact: An Analysis

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Over the 3 months period, Hilton Grand Vacations showcased positive performance, achieving a revenue growth rate of 2.72% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Hilton Grand Vacations's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.67% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Hilton Grand Vacations's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 3.19%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of 0.81%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Hilton Grand Vacations's debt-to-equity ratio is below the industry average at 2.17, reflecting a lower dependency on debt financing and a more conservative financial approach.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.