Across the recent three months, 8 analysts have shared their insights on SoFi Techs SOFI, expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 0 | 3 | 3 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 1 | 0 |

| 2M Ago | 0 | 0 | 1 | 1 | 0 |

| 3M Ago | 1 | 0 | 1 | 1 | 0 |

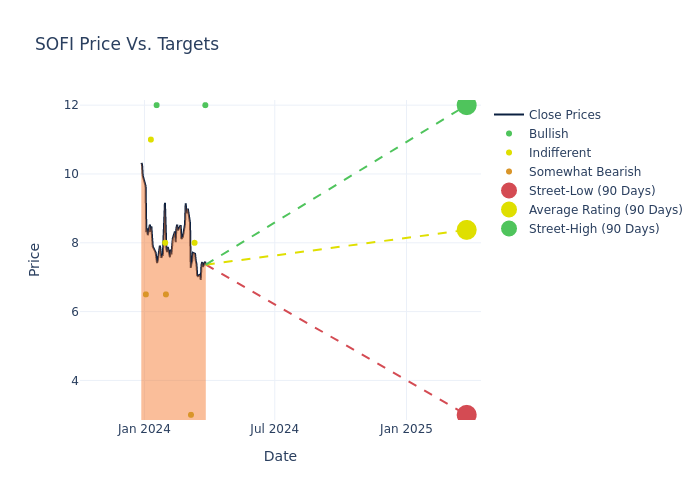

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $8.38, a high estimate of $12.00, and a low estimate of $3.00. This current average has decreased by 16.2% from the previous average price target of $10.00.

Investigating Analyst Ratings: An Elaborate Study

An in-depth analysis of recent analyst actions unveils how financial experts perceive SoFi Techs. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Hecht | Jefferies | Lowers | Buy | $12.00 | $15.00 |

| Kevin Barker | Piper Sandler | Lowers | Neutral | $8.00 | $8.50 |

| David Chiaverini | Wedbush | Maintains | Underperform | $3.00 | - |

| Jeffrey Adelson | Morgan Stanley | Lowers | Underweight | $6.50 | $7.00 |

| Michael Ng | Goldman Sachs | Raises | Neutral | $8.00 | $7.00 |

| Dan Dolev | Mizuho | Lowers | Buy | $12.00 | $15.00 |

| Mark Devries | Deutsche Bank | Announces | Hold | $11.00 | - |

| Michael Perito | Keefe, Bruyette & Woods | Lowers | Underperform | $6.50 | $7.50 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to SoFi Techs. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of SoFi Techs compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Capture valuable insights into SoFi Techs's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on SoFi Techs analyst ratings.

Delving into SoFi Techs's Background

SoFi is a financial-services company that was founded in 2011 and is based in San Francisco. Initially known for its student loan refinancing business, the company has expanded its product offerings to include personal loans, credit cards, mortgages, investment accounts, banking services, and financial planning. The company intends to be a one-stop shop for its clients' finances and operates solely through its mobile app and website. Through its acquisition of Galileo in 2020, the company also offers payment and account services for debit cards and digital banking.

Financial Insights: SoFi Techs

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: SoFi Techs's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 31.57%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: SoFi Techs's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.28% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): SoFi Techs's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 0.73%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): SoFi Techs's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.13%, the company may face hurdles in achieving optimal financial returns.

Debt Management: SoFi Techs's debt-to-equity ratio is below the industry average. With a ratio of 1.02, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.