In the last three months, 4 analysts have published ratings on Beam Therapeutics BEAM, offering a diverse range of perspectives from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

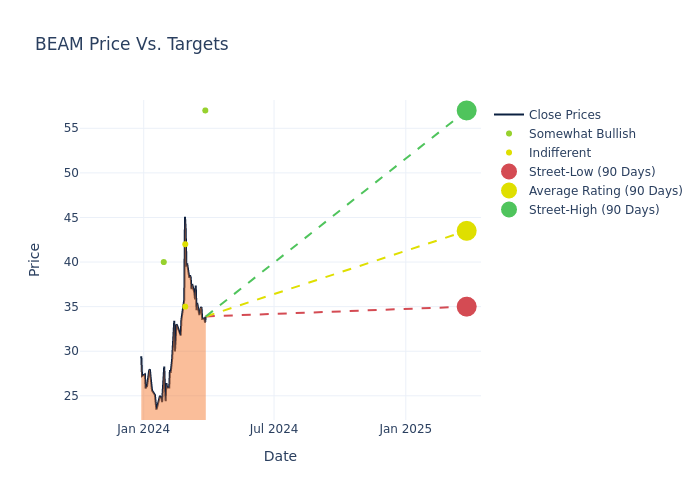

Providing deeper insights, analysts have established 12-month price targets, indicating an average target of $43.5, along with a high estimate of $57.00 and a low estimate of $35.00. This upward trend is apparent, with the current average reflecting a 43.42% increase from the previous average price target of $30.33.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Beam Therapeutics among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kostas Biliouris | BMO Capital | Maintains | Outperform | $57.00 | - |

| Gena Wang | Barclays | Raises | Equal-Weight | $42.00 | $26.00 |

| Luca Issi | RBC Capital | Raises | Sector Perform | $35.00 | $27.00 |

| Eric Joseph | JP Morgan | Raises | Overweight | $40.00 | $38.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Beam Therapeutics. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Beam Therapeutics compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for Beam Therapeutics's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Beam Therapeutics's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Beam Therapeutics analyst ratings.

Get to Know Beam Therapeutics Better

Beam Therapeutics Inc is a biotechnology company engaged in creating genetic medicines based on its base editing technology. This technology enables a new class of genetic medicines that targets a single base in the genome without making a double-stranded break in the DNA. The company's portfolio comprises Gene Correction, Gene Modification, Gene Activation, Gene Silencing, and Multiplex Editing. The company's pipeline programs consist of BEAM-101, ESCAPE, BEAM-302, BEAM-301, and BEAM-201.

Understanding the Numbers: Beam Therapeutics's Finances

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Beam Therapeutics displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 1478.04%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: Beam Therapeutics's net margin excels beyond industry benchmarks, reaching 45.16%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Beam Therapeutics's ROE stands out, surpassing industry averages. With an impressive ROE of 16.22%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Beam Therapeutics's ROA stands out, surpassing industry averages. With an impressive ROA of 10.38%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.18.

The Core of Analyst Ratings: What Every Investor Should Know

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.