7 analysts have expressed a variety of opinions on Builders FirstSource BLDR over the past quarter, offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 5 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 4 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

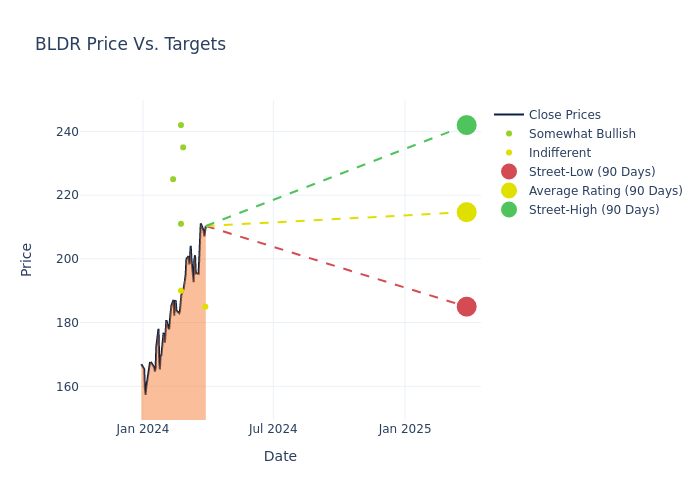

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $215.43, a high estimate of $242.00, and a low estimate of $185.00. Marking an increase of 12.79%, the current average surpasses the previous average price target of $191.00.

Interpreting Analyst Ratings: A Closer Look

The perception of Builders FirstSource by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Kurt Yinger | DA Davidson | Maintains | Neutral | $185.00 | $185.00 |

| Matthew Bouley | Barclays | Raises | Overweight | $235.00 | $195.00 |

| Mike Dahl | RBC Capital | Raises | Outperform | $211.00 | $186.00 |

| Keith Hughes | Truist Securities | Raises | Hold | $190.00 | $185.00 |

| Tyler Batory | Oppenheimer | Raises | Outperform | $242.00 | $220.00 |

| Jay McCanless | Wedbush | Raises | Outperform | $225.00 | $175.00 |

| Tyler Batory | Oppenheimer | Announces | Outperform | $220.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Builders FirstSource. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Builders FirstSource compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Builders FirstSource's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Builders FirstSource's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Builders FirstSource analyst ratings.

About Builders FirstSource

Builders FirstSource Inc is a manufacturer and supplier of building materials. The company offers structural and related building products such as factory-built roof and floor trusses, wall panels and stairs, vinyl windows, custom millwork and trim, and engineered wood. The products can be designed for each home individually and are installed by Builders FirstSource. The company's construction-related services include professional installation, turn-key framing, and shell construction. Builders FirstSource's customers range from large production builders to small custom homebuilders.

Builders FirstSource's Financial Performance

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Negative Revenue Trend: Examining Builders FirstSource's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -4.74% in revenue growth, reflecting a decrease in top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: Builders FirstSource's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 8.45%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 7.53%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Builders FirstSource's ROA stands out, surpassing industry averages. With an impressive ROA of 3.3%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.78.

The Significance of Analyst Ratings Explained

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.