Ratings for Devon Energy DVN were provided by 8 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 3 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 2 | 2 | 0 | 0 | 0 |

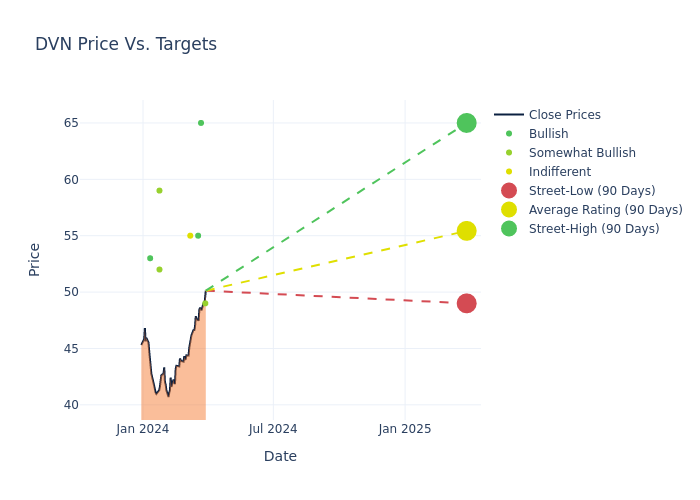

Analysts have recently evaluated Devon Energy and provided 12-month price targets. The average target is $57.88, accompanied by a high estimate of $75.00 and a low estimate of $49.00. A decline of 3.53% from the prior average price target is evident in the current average.

Analyzing Analyst Ratings: A Detailed Breakdown

An in-depth analysis of recent analyst actions unveils how financial experts perceive Devon Energy. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Devin McDermott | Morgan Stanley | Raises | Overweight | $49.00 | $48.00 |

| Derrick Whitfield | Stifel | Lowers | Buy | $65.00 | $75.00 |

| Scott Gruber | Citigroup | Raises | Buy | $55.00 | $52.00 |

| Scott Hanold | RBC Capital | Maintains | Sector Perform | $55.00 | - |

| John Freeman | Raymond James | Lowers | Outperform | $52.00 | $53.00 |

| Mark Lear | Piper Sandler | Lowers | Overweight | $59.00 | $61.00 |

| Derrick Whitfield | Stifel | Lowers | Buy | $75.00 | $77.00 |

| Nitin Kumar | Mizuho | Lowers | Buy | $53.00 | $54.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Devon Energy. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Devon Energy compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Devon Energy's stock. This examination reveals shifts in analysts' expectations over time.

For valuable insights into Devon Energy's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Devon Energy analyst ratings.

All You Need to Know About Devon Energy

Devon Energy Corp, based in Oklahoma City, is one of the largest independent exploration and production companies in North America. The firm's asset base is spread throughout onshore North America and includes exposure to the Delaware, STACK, Eagle Ford, Powder River Basin, and Bakken plays. At year-end 2023, net production totaled roughly 658 thousand boe/d, of which oil and natural gas liquids made up roughly three-quarters of production, with natural gas accounting for the remainder.

Understanding the Numbers: Devon Energy's Finances

Market Capitalization: Exceeding industry standards, the company's market capitalization places it above industry average in size relative to peers. This emphasizes its significant scale and robust market position.

Revenue Growth: Devon Energy's revenue growth over a period of 3 months has faced challenges. As of 31 December, 2023, the company experienced a revenue decline of approximately -3.58%. This indicates a decrease in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Energy sector.

Net Margin: Devon Energy's net margin lags behind industry averages, suggesting challenges in maintaining strong profitability. With a net margin of 27.79%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 9.72%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Devon Energy's ROA excels beyond industry benchmarks, reaching 4.73%. This signifies efficient management of assets and strong financial health.

Debt Management: Devon Energy's debt-to-equity ratio is notably higher than the industry average. With a ratio of 0.53, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.