Providing a diverse range of perspectives from bullish to bearish, 5 analysts have published ratings on Bank OZK OZK in the last three months.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 1 | 2 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 0 | 1 | 0 | 1 | 0 |

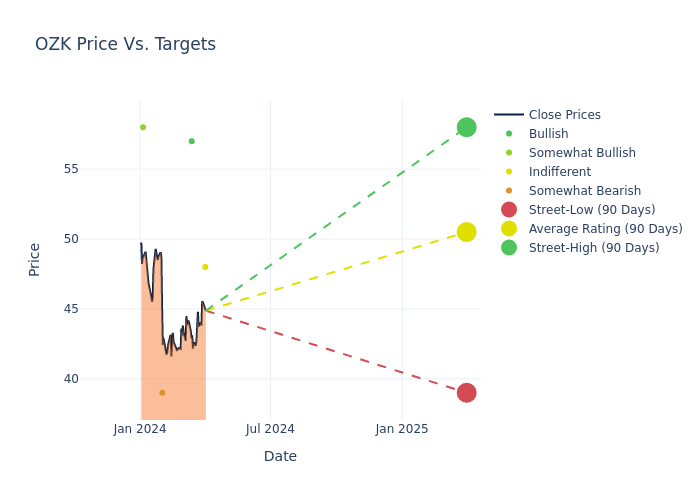

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $48.6, a high estimate of $58.00, and a low estimate of $39.00. Observing a downward trend, the current average is 5.94% lower than the prior average price target of $51.67.

Breaking Down Analyst Ratings: A Detailed Examination

The perception of Bank OZK by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brandon King | Truist Securities | Lowers | Hold | $48.00 | $52.00 |

| Ben Gerlinger | Citigroup | Lowers | Buy | $57.00 | $62.00 |

| Jared Shaw | Wells Fargo | Lowers | Underweight | $39.00 | $41.00 |

| Michael Rose | Raymond James | Announces | Outperform | $58.00 | - |

| Jared Shaw | Wells Fargo | Announces | Underweight | $41.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Bank OZK. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Bank OZK compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Bank OZK's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Bank OZK's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Bank OZK analyst ratings.

Get to Know Bank OZK Better

Bank OZK is a bank holding company that owns and operates a community bank, Bank of the Ozarks. The bank operates offices in Arkansas, Georgia, Florida, North Carolina, Texas, California, New York and Mississippi. It provides a range of banking services which include deposit services such as checking, savings, money market, time deposit and individual retirement accounts to loan services like real estate, consumer, commercial and industrial loans. Apart from providing traditional banking products and services it also provides treasury management, trust and wealth management, financial planning, online banking and other related services.

Financial Milestones: Bank OZK's Journey

Market Capitalization Analysis: Reflecting a smaller scale, the company's market capitalization is positioned below industry averages. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Bank OZK displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 13.62%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Financials sector.

Net Margin: Bank OZK's net margin is impressive, surpassing industry averages. With a net margin of 41.18%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 3.65%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 0.51%, the company showcases effective utilization of assets.

Debt Management: Bank OZK's debt-to-equity ratio is below the industry average at 0.27, reflecting a lower dependency on debt financing and a more conservative financial approach.

What Are Analyst Ratings?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.