4 analysts have expressed a variety of opinions on Carlisle Companies CSL over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 2 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

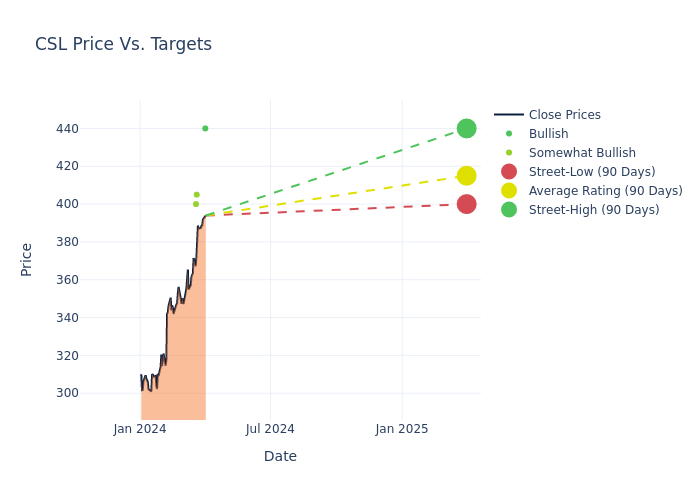

Insights from analysts' 12-month price targets are revealed, presenting an average target of $399.75, a high estimate of $440.00, and a low estimate of $354.00. This upward trend is apparent, with the current average reflecting a 10.66% increase from the previous average price target of $361.25.

Exploring Analyst Ratings: An In-Depth Overview

An in-depth analysis of recent analyst actions unveils how financial experts perceive Carlisle Companies. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Garik Shmois | Loop Capital | Raises | Buy | $440.00 | $375.00 |

| Bryan Blair | Oppenheimer | Raises | Outperform | $405.00 | $355.00 |

| Timothy Wojs | Baird | Raises | Outperform | $400.00 | $365.00 |

| Timothy Wojs | Baird | Raises | Outperform | $354.00 | $350.00 |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Carlisle Companies. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Carlisle Companies compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Carlisle Companies's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Carlisle Companies analyst ratings.

All You Need to Know About Carlisle Companies

Carlisle Companies Inc is a holding company. The company manufactures and sells single-ply roofing products and warranted systems and accessories for the commercial building industry. The company is organized into two segments including Carlisle Construction Materials and Carlisle Weatherproofing Technologies. The company's product portfolio includes moisture protection products, protective roofing underlayments, integrated air and vapor barriers, spray polyurethane foam and coating systems, and others. The majority of the company's revenue comes from the Carlisle Construction Materials segment, and more than half of the total revenue is earned in the United States.

Financial Milestones: Carlisle Companies's Journey

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Negative Revenue Trend: Examining Carlisle Companies's financials over 3 months reveals challenges. As of 31 December, 2023, the company experienced a decline of approximately -1.95% in revenue growth, reflecting a decrease in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Carlisle Companies's net margin excels beyond industry benchmarks, reaching 18.19%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Carlisle Companies's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 7.13%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Carlisle Companies's ROA stands out, surpassing industry averages. With an impressive ROA of 3.05%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Carlisle Companies's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.82.

How Are Analyst Ratings Determined?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.