Ratings for Lumentum Holdings LITE were provided by 8 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 3 | 1 | 1 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 2 | 2 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 1 | 0 |

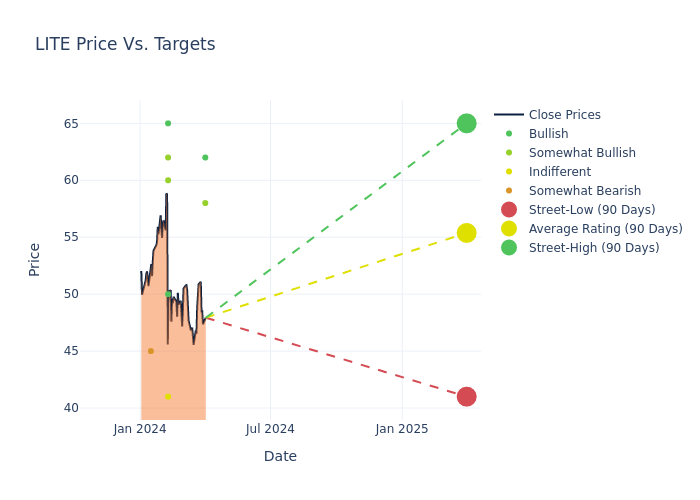

Analysts have recently evaluated Lumentum Holdings and provided 12-month price targets. The average target is $55.38, accompanied by a high estimate of $65.00 and a low estimate of $41.00. Observing a 1.08% increase, the current average has risen from the previous average price target of $54.79.

Analyzing Analyst Ratings: A Detailed Breakdown

The standing of Lumentum Holdings among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Simon Leopold | Raymond James | Raises | Outperform | $58.00 | $51.50 |

| Ruben Roy | Stifel | Maintains | Buy | $62.00 | $62.00 |

| Samik Chatterjee | JP Morgan | Lowers | Overweight | $62.00 | $63.00 |

| Dave Kang | B. Riley Securities | Lowers | Neutral | $41.00 | $42.00 |

| Christopher Rolland | Susquehanna | Lowers | Positive | $60.00 | $65.00 |

| Mike Genovese | Rosenblatt | Raises | Buy | $65.00 | $60.00 |

| Alex Henderson | Needham | Maintains | Buy | $50.00 | - |

| Tom O'Malley | Barclays | Raises | Underweight | $45.00 | $40.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Lumentum Holdings. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Analyzing trends, analysts offer qualitative evaluations, ranging from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Lumentum Holdings compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Lumentum Holdings's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Lumentum Holdings's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Lumentum Holdings analyst ratings.

Unveiling the Story Behind Lumentum Holdings

Lumentum Holdings Inc is a California-based technology firm. The company provides two types of optical and photonic products: optical components that are used in telecommunications networking equipment, and commercial lasers for manufacturing, inspection, and life-science lab uses. Its segments are OpComms and Lasers. The firm is also expanding into new optical applications, such as 3-D sensing laser diode for consumer electronics. It generates maximum revenue from the OpComms segment. The OpComms segment products include a wide range of components, modules and subsystems to support customers including carrier networks for access (local), metro (intracity), long-haul, and submarine (undersea) applications.

Lumentum Holdings: Financial Performance Dissected

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Decline in Revenue: Over the 3 months period, Lumentum Holdings faced challenges, resulting in a decline of approximately -27.51% in revenue growth as of 31 December, 2023. This signifies a reduction in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Lumentum Holdings's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of -27.02%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Lumentum Holdings's ROE lags behind industry averages, suggesting challenges in maximizing returns on equity capital. With an ROE of -7.66%, the company may face hurdles in achieving optimal financial performance.

Return on Assets (ROA): The company's ROA is below industry benchmarks, signaling potential difficulties in efficiently utilizing assets. With an ROA of -2.15%, the company may need to address challenges in generating satisfactory returns from its assets.

Debt Management: Lumentum Holdings's debt-to-equity ratio is notably higher than the industry average. With a ratio of 2.26, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: What Are They?

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.