8 analysts have expressed a variety of opinions on Johnson Controls Intl JCI over the past quarter, offering a diverse set of opinions from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 4 | 2 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 2 | 0 |

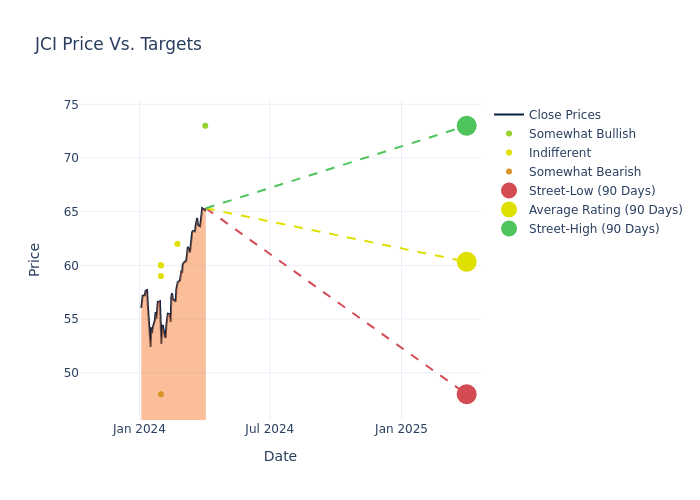

Analysts have recently evaluated Johnson Controls Intl and provided 12-month price targets. The average target is $59.5, accompanied by a high estimate of $73.00 and a low estimate of $48.00. Marking an increase of 0.56%, the current average surpasses the previous average price target of $59.17.

Interpreting Analyst Ratings: A Closer Look

The perception of Johnson Controls Intl by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Joe O'Dea | Wells Fargo | Raises | Overweight | $73.00 | $64.00 |

| Brett Linzey | Mizuho | Maintains | Neutral | $62.00 | $62.00 |

| Deane Dray | RBC Capital | Lowers | Underperform | $48.00 | $50.00 |

| Puneet Garg | HSBC | Announces | Hold | $60.00 | - |

| Joe O'Dea | Wells Fargo | Lowers | Overweight | $64.00 | $65.00 |

| Julian Mitchell | Barclays | Lowers | Equal-Weight | $59.00 | $60.00 |

| Nicole Deblase | Deutsche Bank | Announces | Hold | $60.00 | - |

| Deane Dray | RBC Capital | Lowers | Underperform | $50.00 | $54.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Johnson Controls Intl. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Johnson Controls Intl compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Johnson Controls Intl's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Johnson Controls Intl's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Johnson Controls Intl analyst ratings.

Delving into Johnson Controls Intl's Background

Johnson Controls manufactures, installs, and services HVAC systems, building management systems and controls, industrial refrigeration units, and fire and security solutions. Commercial HVAC accounts for over 45% of sales, fire and security represents roughly 40% of sales, and residential HVAC, industrial refrigeration, and other solutions account for the remaining 15% of revenue. In fiscal 2023, Johnson Controls generated nearly $27 billion in revenue.

Johnson Controls Intl's Financial Performance

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: Johnson Controls Intl's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 0.43%. This indicates a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Johnson Controls Intl's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of 6.14%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Johnson Controls Intl's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of 2.24%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Johnson Controls Intl's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of 0.85%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.64, Johnson Controls Intl adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.