McCormick & Co MKC has been analyzed by 7 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 0 | 3 | 1 | 2 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 2 | 0 | 1 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 1 | 1 |

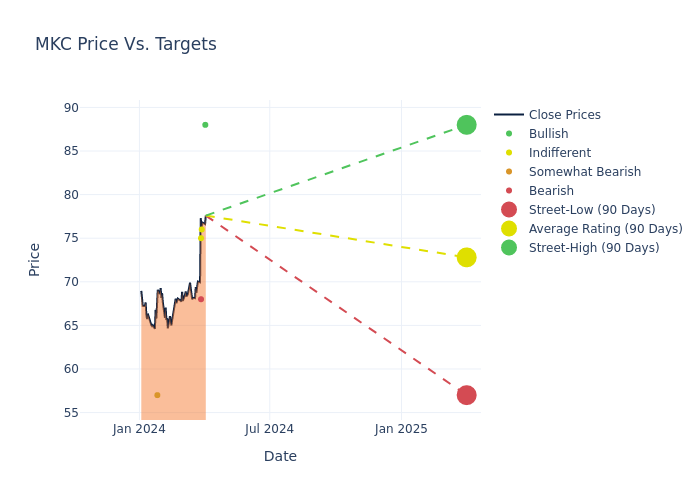

The 12-month price targets, analyzed by analysts, offer insights with an average target of $70.71, a high estimate of $88.00, and a low estimate of $57.00. This upward trend is apparent, with the current average reflecting a 5.85% increase from the previous average price target of $66.80.

Diving into Analyst Ratings: An In-Depth Exploration

In examining recent analyst actions, we gain insights into how financial experts perceive McCormick & Co. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Staszak | Argus Research | Announces | Buy | $88.00 | - |

| Andrew Lazar | Barclays | Raises | Equal-Weight | $76.00 | $71.00 |

| Matthew Smith | Stifel | Raises | Hold | $75.00 | $70.00 |

| Thomas Palmer | Citigroup | Raises | Sell | $68.00 | $60.00 |

| Thomas Palmer | Citigroup | Announces | Sell | $60.00 | - |

| Ken Goldman | JP Morgan | Lowers | Underweight | $57.00 | $59.00 |

| Lauren Lieberman | Barclays | Lowers | Equal-Weight | $71.00 | $74.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to McCormick & Co. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of McCormick & Co compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of McCormick & Co's stock. This comparison reveals trends in analysts' expectations over time.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into McCormick & Co's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on McCormick & Co analyst ratings.

About McCormick & Co

In its more than 130-year history, McCormick has grown to become the leading global manufacturer, marketer, and distributor of spices, herbs, extracts, seasonings, and other flavorings. Beyond end consumers, McCormick's customer base also includes top quick-service restaurants, retail grocery chains, and other packaged food and beverage manufacturers. And its reach is global, with nearly 40% of sales generated beyond its home turf to include 170 other countries and territories. In addition to its namesake brand, the firm's portfolio includes Old Bay, Zatarain's, Thai Kitchen, Frank's RedHot, French's, and Cholula, among others.

Understanding the Numbers: McCormick & Co's Finances

Market Capitalization Analysis: With a profound presence, the company's market capitalization is above industry averages. This reflects substantial size and strong market recognition.

Revenue Growth: McCormick & Co's remarkable performance in 3 months is evident. As of 29 February, 2024, the company achieved an impressive revenue growth rate of 2.38%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company encountered difficulties, with a growth rate lower than the average among peers in the Consumer Staples sector.

Net Margin: McCormick & Co's net margin is impressive, surpassing industry averages. With a net margin of 10.36%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): McCormick & Co's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of 3.23%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): McCormick & Co's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 1.29%, the company may face hurdles in achieving optimal financial returns.

Debt Management: McCormick & Co's debt-to-equity ratio is below the industry average. With a ratio of 0.85, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

In addition to their assessments, some analysts extend their insights by offering predictions for key metrics such as earnings, revenue, and growth estimates. This supplementary information provides further guidance for traders. It is crucial to recognize that, despite their specialization, analysts are human and can only provide forecasts based on their beliefs.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.