Parker Hannifin PH underwent analysis by 8 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

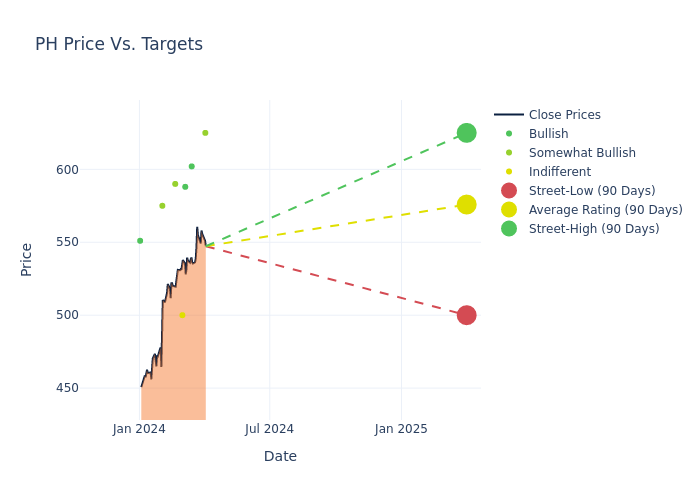

In the assessment of 12-month price targets, analysts unveil insights for Parker Hannifin, presenting an average target of $567.25, a high estimate of $625.00, and a low estimate of $500.00. This upward trend is apparent, with the current average reflecting a 20.03% increase from the previous average price target of $472.60.

Understanding Analyst Ratings: A Comprehensive Breakdown

A clear picture of Parker Hannifin's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Julian Mitchell | Barclays | Raises | Overweight | $625.00 | $558.00 |

| Jamie Cook | Truist Securities | Announces | Buy | $602.00 | - |

| Nathan Jones | Stifel | Maintains | Buy | $588.00 | - |

| Joseph Giordano | TD Cowen | Raises | Market Perform | $500.00 | $300.00 |

| David Raso | Evercore ISI Group | Raises | Outperform | $590.00 | $505.00 |

| Julian Mitchell | Barclays | Raises | Overweight | $558.00 | $500.00 |

| Jeffrey Hammond | Keybanc | Raises | Overweight | $575.00 | $500.00 |

| Nathan Jones | Stifel | Maintains | Buy | $500.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Parker Hannifin. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Parker Hannifin compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of Parker Hannifin's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Parker Hannifin's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Parker Hannifin analyst ratings.

Discovering Parker Hannifin: A Closer Look

Parker Hannifin is an industrial conglomerate operating through two segments: diversified industrial, which serves a variety of end markets, and aerospace systems, which sells engine and actuation components. The diversified industrial segment consists of six groups, including engineered materials (sealing devices), filtration (filters and systems monitoring and removing contaminants from liquids and gases), fluid connectors (valves, couplings, and other fittings), instrumentation (flow manufacturing components and fluid control applications), and motion systems (hydraulic, pneumatic, and electromechanical components in industrial machinery and equipment). The segment boasts 17,100 independent distributors, and about 40% of its business occurs outside the United States.

Financial Insights: Parker Hannifin

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, Parker Hannifin showcased positive performance, achieving a revenue growth rate of 3.13% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Industrials sector.

Net Margin: Parker Hannifin's net margin is impressive, surpassing industry averages. With a net margin of 14.14%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): Parker Hannifin's ROE excels beyond industry benchmarks, reaching 6.24%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Parker Hannifin's ROA excels beyond industry benchmarks, reaching 2.3%. This signifies efficient management of assets and strong financial health.

Debt Management: Parker Hannifin's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.04, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

Analyst Ratings: Simplified

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.