Providing a diverse range of perspectives from bullish to bearish, 10 analysts have published ratings on NIO NIO in the last three months.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 5 | 3 | 0 |

| Last 30D | 0 | 0 | 0 | 1 | 0 |

| 1M Ago | 1 | 1 | 5 | 1 | 0 |

| 2M Ago | 0 | 0 | 0 | 1 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

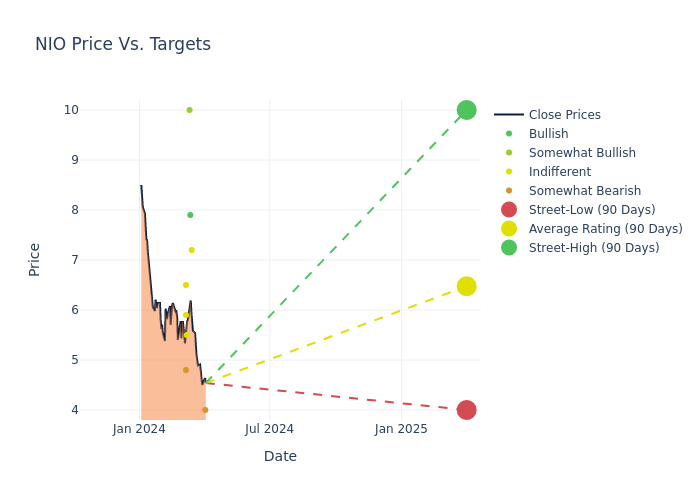

Analysts have set 12-month price targets for NIO, revealing an average target of $6.18, a high estimate of $10.00, and a low estimate of $4.00. This current average has decreased by 23.7% from the previous average price target of $8.10.

Diving into Analyst Ratings: An In-Depth Exploration

The analysis of recent analyst actions sheds light on the perception of NIO by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jiong Shao | Barclays | Lowers | Underweight | $4.00 | $5.00 |

| Paul Gong | UBS | Lowers | Neutral | $7.20 | $8.00 |

| Yuqian Ding | HSBC | Lowers | Buy | $7.90 | $10.20 |

| Tim Hsiao | Morgan Stanley | Lowers | Overweight | $10.00 | $13.00 |

| Eunice Lee | Bernstein | Lowers | Market Perform | $5.50 | $7.50 |

| Ming Hsun Lee | B of A Securities | Lowers | Neutral | $6.50 | $7.50 |

| Xiaoyi Lei | Jefferies | Lowers | Hold | $5.90 | $8.30 |

| Jiong Shao | Barclays | Lowers | Equal-Weight | $5.00 | $8.00 |

| Nick Lai | JP Morgan | Lowers | Underweight | $4.80 | $5.00 |

| Nick Lai | JP Morgan | Lowers | Underweight | $5.00 | $8.50 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to NIO. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of NIO compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of NIO's stock. This examination reveals shifts in analysts' expectations over time.

Capture valuable insights into NIO's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on NIO analyst ratings.

Get to Know NIO Better

Nio is a leading electric vehicle maker, targeting the premium segment. Founded in November 2014, Nio designs, develops, jointly manufactures, and sells premium smart electric vehicles. The company differentiates itself through continuous technological breakthroughs and innovations such as battery swapping and autonomous driving technologies. Nio launched its first model, its ES8 seven-seater electric SUV, in December 2017, and began deliveries in June 2018. Its current model portfolio includes midsize to large sedans and SUVs. It sold over 160,000 EVs in 2023, accounting for about 2% of the China passenger new energy vehicle market.

NIO: Delving into Financials

Market Capitalization Analysis: Positioned below industry benchmarks, the company's market capitalization faces constraints in size. This could be influenced by factors such as growth expectations or operational capacity.

Revenue Challenges: NIO's revenue growth over 3 months faced difficulties. As of 31 December, 2023, the company experienced a decline of approximately -10.3%. This indicates a decrease in top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: NIO's net margin is impressive, surpassing industry averages. With a net margin of -32.7%, the company demonstrates strong profitability and effective cost management.

Return on Equity (ROE): NIO's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -27.11%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): NIO's ROA excels beyond industry benchmarks, reaching -5.09%. This signifies efficient management of assets and strong financial health.

Debt Management: NIO's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.36, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.