Across the recent three months, 11 analysts have shared their insights on UnitedHealth Group UNH, expressing a variety of opinions spanning from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 9 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 2 | 0 | 0 | 0 |

| 3M Ago | 0 | 5 | 0 | 0 | 0 |

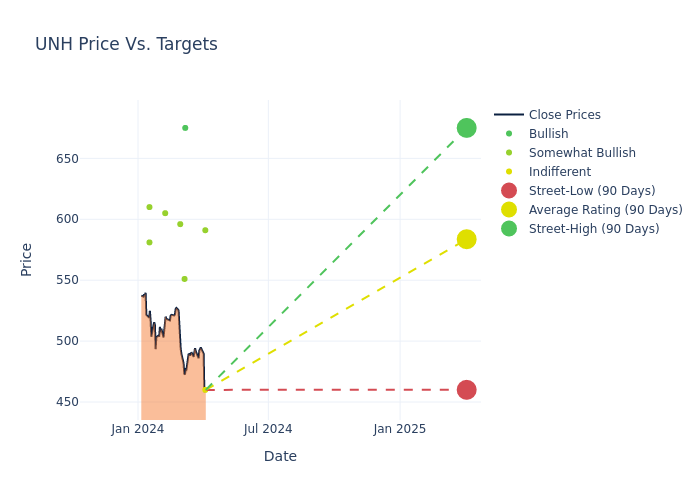

In the assessment of 12-month price targets, analysts unveil insights for UnitedHealth Group, presenting an average target of $587.36, a high estimate of $675.00, and a low estimate of $460.00. Highlighting a 5.97% decrease, the current average has fallen from the previous average price target of $624.67.

Investigating Analyst Ratings: An Elaborate Study

A clear picture of UnitedHealth Group's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Rajesh Kumar | HSBC | Announces | Hold | $460.00 | - |

| Sarah James | Cantor Fitzgerald | Maintains | Overweight | $591.00 | - |

| Kevin Fischbeck | B of A Securities | Maintains | Buy | $675.00 | $675.00 |

| Andrew Mok | Barclays | Announces | Overweight | $551.00 | - |

| Ben Hendrix | RBC Capital | Maintains | Outperform | $596.00 | - |

| Scott Fidel | Stephens & Co. | Maintains | Overweight | $605.00 | - |

| Sarah James | Cantor Fitzgerald | Maintains | Overweight | $591.00 | - |

| Michael Wiederhorn | Oppenheimer | Maintains | Outperform | $610.00 | - |

| Jessica Tassan | Piper Sandler | Lowers | Overweight | $581.00 | $584.00 |

| Scott Fidel | Stephens & Co. | Lowers | Overweight | $605.00 | $615.00 |

| Ben Hendrix | RBC Capital | Maintains | Outperform | $596.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to UnitedHealth Group. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of UnitedHealth Group compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of UnitedHealth Group's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on UnitedHealth Group analyst ratings.

Get to Know UnitedHealth Group Better

UnitedHealth Group is one of the largest private health insurers, providing medical benefits to about 53 million members globally, including 5 million outside the U.S. as of mid-2023. As a leader in employer-sponsored, self-directed, and government-backed insurance plans, UnitedHealth has obtained massive scale in managed care. Along with its insurance assets, UnitedHealth's continued investments in its Optum franchises have created a healthcare services colossus that spans everything from medical and pharmaceutical benefits to providing outpatient care and analytics to both affiliated and third-party customers.

Understanding the Numbers: UnitedHealth Group's Finances

Market Capitalization Analysis: With an elevated market capitalization, the company stands out above industry averages, showcasing substantial size and market acknowledgment.

Revenue Growth: UnitedHealth Group displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 14.06%. This indicates a notable increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 5.78%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): UnitedHealth Group's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 6.3% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): UnitedHealth Group's ROA stands out, surpassing industry averages. With an impressive ROA of 1.96%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: UnitedHealth Group's debt-to-equity ratio surpasses industry norms, standing at 0.7. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

The Significance of Analyst Ratings Explained

Analyst ratings serve as essential indicators of stock performance, provided by experts in banking and financial systems. These specialists diligently analyze company financial statements, participate in conference calls, and engage with insiders to generate quarterly ratings for individual stocks.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.