11 analysts have shared their evaluations of Intercontinental Exchange ICE during the recent three months, expressing a mix of bullish and bearish perspectives.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 5 | 1 | 0 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 3 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

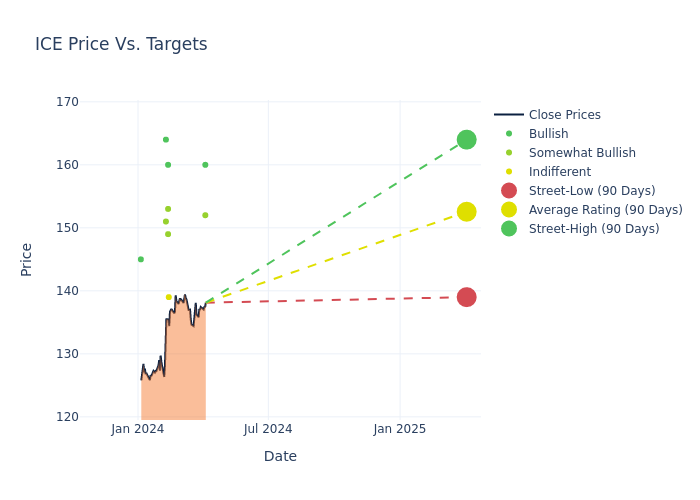

The 12-month price targets, analyzed by analysts, offer insights with an average target of $152.45, a high estimate of $164.00, and a low estimate of $139.00. This current average reflects an increase of 8.27% from the previous average price target of $140.80.

Decoding Analyst Ratings: A Detailed Look

The analysis of recent analyst actions sheds light on the perception of Intercontinental Exchange by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Christopher Allen | Citigroup | Raises | Buy | $160.00 | $155.00 |

| Kyle Voigt | Keefe, Bruyette & Woods | Maintains | Outperform | $152.00 | - |

| Michael Cyprys | Morgan Stanley | Raises | Equal-Weight | $139.00 | $133.00 |

| Christopher Allen | Citigroup | Raises | Buy | $155.00 | $146.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $153.00 | $148.00 |

| Alex Kramm | UBS | Raises | Buy | $160.00 | $145.00 |

| Patrick Moley | Piper Sandler | Raises | Overweight | $149.00 | $135.00 |

| Ken Worthington | JP Morgan | Raises | Overweight | $151.00 | $142.00 |

| Andrew Bond | Rosenblatt | Raises | Buy | $164.00 | $154.00 |

| Christopher Allen | Citigroup | Raises | Buy | $146.00 | $130.00 |

| Benjamin Budish | Barclays | Raises | Overweight | $148.00 | $120.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Intercontinental Exchange. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Intercontinental Exchange compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Intercontinental Exchange's stock. This comparison reveals trends in analysts' expectations over time.

Considering these analyst evaluations in conjunction with other financial indicators can offer a comprehensive understanding of Intercontinental Exchange's market position. Stay informed and make well-informed decisions with our Ratings Table.

Stay up to date on Intercontinental Exchange analyst ratings.

About Intercontinental Exchange

Intercontinental Exchange is a vertically integrated operator of financial exchanges and provides ancillary data products. Though the company is probably best known for its ownership of the New York Stock Exchange, which it acquired in 2013, ICE operates a large derivatives exchange, too. The company's largest commodity futures product is the ICE Brent crude futures contract. In addition to the exchanges business, which is about 56% of net revenue, Intercontinental Exchange has used a series of acquisitions to create its mortgage technology business (15% of net revenue) and fixed-income and data services segment (29% of net revenue).

Intercontinental Exchange's Economic Impact: An Analysis

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Positive Revenue Trend: Examining Intercontinental Exchange's financials over 3 months reveals a positive narrative. The company achieved a noteworthy revenue growth rate of 12.16% as of 31 December, 2023, showcasing a substantial increase in top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Financials sector.

Net Margin: The company's net margin is below industry benchmarks, signaling potential difficulties in achieving strong profitability. With a net margin of 13.99%, the company may need to address challenges in effective cost control.

Return on Equity (ROE): The company's ROE is a standout performer, exceeding industry averages. With an impressive ROE of 1.46%, the company showcases effective utilization of equity capital.

Return on Assets (ROA): Intercontinental Exchange's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 0.27%, the company may face hurdles in achieving optimal financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 0.89, caution is advised due to increased financial risk.

Analyst Ratings: What Are They?

Within the domain of banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their work involves attending company conference calls and meetings, researching company financial statements, and communicating with insiders to publish "analyst ratings" for stocks. Analysts typically assess and rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.