Throughout the last three months, 20 analysts have evaluated UiPath PATH, offering a diverse set of opinions from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 5 | 3 | 12 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 5 | 2 | 11 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 1 | 0 | 0 |

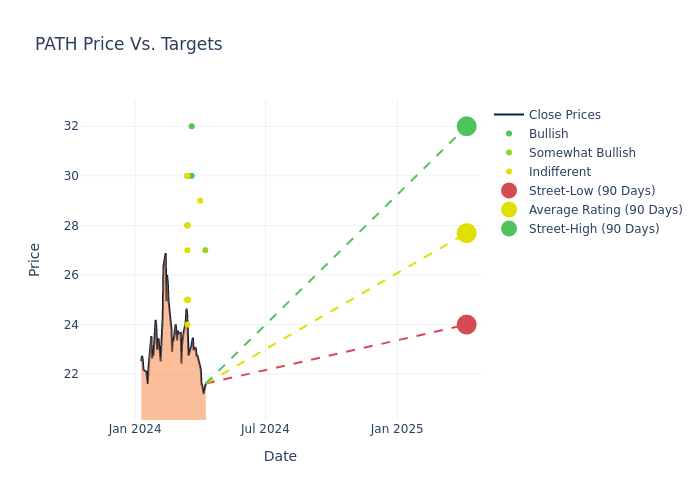

The 12-month price targets, analyzed by analysts, offer insights with an average target of $27.7, a high estimate of $32.00, and a low estimate of $23.00. This upward trend is evident, with the current average reflecting a 16.73% increase from the previous average price target of $23.73.

Interpreting Analyst Ratings: A Closer Look

A comprehensive examination of how financial experts perceive UiPath is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Jason Celino | Keybanc | Announces | Overweight | $27.00 | - |

| Matthew Hedberg | RBC Capital | Maintains | Sector Perform | $29.00 | - |

| Terry Tillman | Truist Securities | Maintains | Buy | $32.00 | - |

| Matthew Hedberg | RBC Capital | Maintains | Sector Perform | $29.00 | - |

| Scott Berg | Needham | Maintains | Buy | $30.00 | - |

| Kingsley Crane | Canaccord Genuity | Raises | Buy | $30.00 | $27.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $25.00 | $23.00 |

| Bryan Bergin | TD Cowen | Raises | Outperform | $28.00 | $25.00 |

| Keith Weiss | Morgan Stanley | Raises | Equal-Weight | $25.00 | $17.00 |

| Kirk Materne | Evercore ISI Group | Raises | In-Line | $27.00 | $24.00 |

| Keith Bachman | BMO Capital | Raises | Market Perform | $28.00 | $24.00 |

| Matthew Hedberg | RBC Capital | Raises | Sector Perform | $29.00 | $27.00 |

| Nick Altmann | Scotiabank | Raises | Sector Perform | $30.00 | $29.00 |

| Siti Panigrahi | Mizuho | Raises | Neutral | $25.00 | $22.00 |

| Gil Luria | DA Davidson | Raises | Neutral | $24.00 | $20.00 |

| Mark Murphy | JP Morgan | Raises | Overweight | $28.00 | $22.00 |

| Michael Turrin | Wells Fargo | Raises | Equal-Weight | $25.00 | $24.00 |

| Brad Sills | B of A Securities | Raises | Buy | $30.00 | $26.00 |

| Scott Berg | Needham | Raises | Buy | $30.00 | $25.00 |

| Raimo Lenschow | Barclays | Raises | Equal-Weight | $23.00 | $21.00 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to UiPath. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Analysts assign qualitative assessments to stocks, ranging from 'Outperform' to 'Underperform'. These ratings convey the analysts' expectations for the relative performance of UiPath compared to the broader market.

- Price Targets: Gaining insights, analysts provide estimates for the future value of UiPath's stock. This comparison reveals trends in analysts' expectations over time.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of UiPath's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on UiPath analyst ratings.

Delving into UiPath's Background

UiPath Inc creates an end-to-end platform that provides automation with user emulation at its core. Its platform is built to be used by employees throughout a company and to address a wide variety of use cases, from simple tasks to long-running, complex business processes. It generates revenue from the sale of licenses for its proprietary software, maintenance and support, the right to access certain software products it hosts (i.e., SaaS) and professional services. It generates a majority of its revenues from the Americas followed by Europe, Middle East, and Africa and Asia-Pacific.

Unraveling the Financial Story of UiPath

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: UiPath displayed positive results in 3 months. As of 31 January, 2024, the company achieved a solid revenue growth rate of approximately 31.34%. This indicates a notable increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Information Technology sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 8.37%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): UiPath's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.71%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 1.18%, the company showcases effective utilization of assets.

Debt Management: With a below-average debt-to-equity ratio of 0.03, UiPath adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Significance of Analyst Ratings Explained

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.