Across the recent three months, 7 analysts have shared their insights on Caesars Entertainment CZR, expressing a variety of opinions spanning from bullish to bearish.

The table below offers a condensed view of their recent ratings, showcasing the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 3 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 3 | 2 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

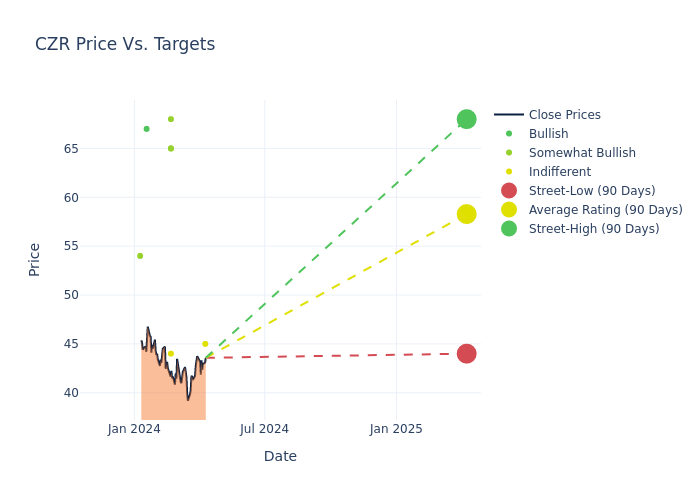

Analysts have recently evaluated Caesars Entertainment and provided 12-month price targets. The average target is $56.86, accompanied by a high estimate of $68.00 and a low estimate of $44.00. A 1.68% drop is evident in the current average compared to the previous average price target of $57.83.

Understanding Analyst Ratings: A Comprehensive Breakdown

The standing of Caesars Entertainment among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Stephen Grambling | Morgan Stanley | Raises | Equal-Weight | $45.00 | $44.00 |

| Stephen Grambling | Morgan Stanley | Lowers | Equal-Weight | $44.00 | $45.00 |

| Daniel Politzer | Wells Fargo | Lowers | Overweight | $68.00 | $72.00 |

| Jordan Bender | JMP Securities | Maintains | Market Outperform | $65.00 | - |

| Joseph Stauff | Susquehanna | Lowers | Neutral | $44.00 | $49.00 |

| Brandt Montour | Barclays | Lowers | Overweight | $65.00 | $67.00 |

| Steven Wieczynski | Stifel | Lowers | Buy | $67.00 | $70.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Caesars Entertainment. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Caesars Entertainment compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Caesars Entertainment's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Caesars Entertainment's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Caesars Entertainment analyst ratings.

Delving into Caesars Entertainment's Background

Caesars Entertainment includes about 50 domestic gaming properties across Las Vegas (49% of 2023 EBITDAR before corporate expenses) and regional (48%) markets. Additionally, the company hosts managed properties and digital assets, the later of which produced marginal EBITDA in 2023. Caesars' US presence roughly doubled with the 2020 acquisition by Eldorado, which built its first casino in Reno, Nevada, in 1973 and expanded its presence through prior acquisitions to over 20 properties before merging with legacy Caesars. Caesars' brands include Caesars, Harrah's, Tropicana, Bally's, Isle, and Flamingo. Also, the company owns the US portion of William Hill (it sold the international operation in 2022), a digital sports betting platform.

Caesars Entertainment's Economic Impact: An Analysis

Market Capitalization Analysis: Above industry benchmarks, the company's market capitalization emphasizes a noteworthy size, indicative of a strong market presence.

Revenue Growth: Caesars Entertainment's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 0.14%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the revenue growth lags behind its industry peers. The company achieved a growth rate lower than the average among peers in Consumer Discretionary sector.

Net Margin: Caesars Entertainment's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -2.55%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Caesars Entertainment's ROE is below industry averages, indicating potential challenges in efficiently utilizing equity capital. With an ROE of -1.57%, the company may face hurdles in achieving optimal financial returns.

Return on Assets (ROA): Caesars Entertainment's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.22%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Caesars Entertainment's debt-to-equity ratio is notably higher than the industry average. With a ratio of 5.51, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Basics of Analyst Ratings

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.