4 analysts have expressed a variety of opinions on Augmedix AUGX over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 1 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 2 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

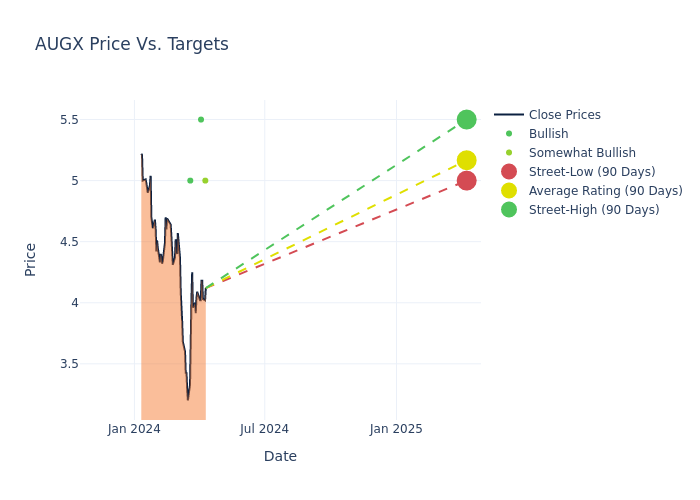

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $5.0, a high estimate of $5.50, and a low estimate of $4.50. A decline of 14.24% from the prior average price target is evident in the current average.

Decoding Analyst Ratings: A Detailed Look

A clear picture of Augmedix's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Elizabeth Anderson | Evercore ISI Group | Raises | Outperform | $5.00 | $4.50 |

| Neil Chatterji | B. Riley Securities | Announces | Buy | $5.50 | - |

| Elizabeth Anderson | Evercore ISI Group | Lowers | In-Line | $4.50 | $6.50 |

| Allen Klee | Maxim Group | Lowers | Buy | $5.00 | $6.50 |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Augmedix. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Augmedix compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Augmedix's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into Augmedix's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Augmedix analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Get to Know Augmedix Better

Augmedix Inc is engaged in ambulatory/clinical/hospital segments of the U.S. patient care services market with products that address medical note documentation needs. The company's products cater to large and small healthcare organizations but can also be adopted by individual practitioners. The company products extract data from natural clinician-patient conversations and convert it in real time to medical notes, which are seamlessly transferred to the electronic health record (EHR). The company's revenues consist of service fees charged to its customers to subscribe to the company's remote medical documentation and clinical support products.

Financial Milestones: Augmedix's Journey

Market Capitalization: Indicating a reduced size compared to industry averages, the company's market capitalization poses unique challenges.

Revenue Growth: Augmedix displayed positive results in 3 months. As of 31 December, 2023, the company achieved a solid revenue growth rate of approximately 44.9%. This indicates a notable increase in the company's top-line earnings. When compared to others in the Health Care sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Augmedix's financial strength is reflected in its exceptional net margin, which exceeds industry averages. With a remarkable net margin of -35.43%, the company showcases strong profitability and effective cost management.

Return on Equity (ROE): Augmedix's ROE stands out, surpassing industry averages. With an impressive ROE of -37.35%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): Augmedix's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of -8.35%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Augmedix's debt-to-equity ratio is notably higher than the industry average. With a ratio of 1.11, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Significance of Analyst Ratings Explained

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.