Ratings for BorgWarner BWA were provided by 7 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 6 | 1 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 3 | 1 | 0 | 0 |

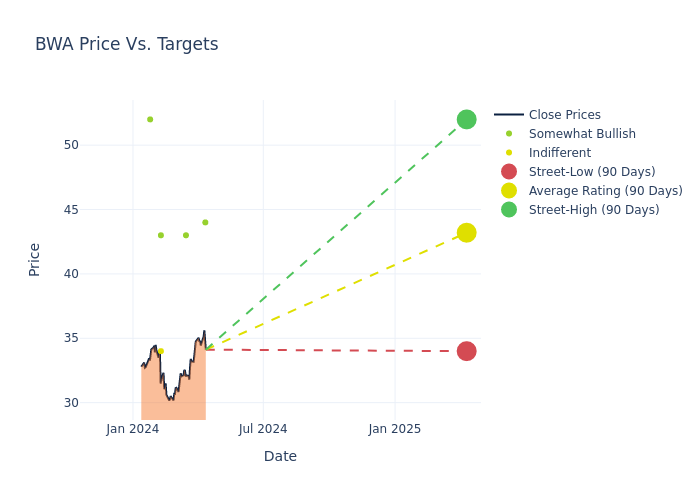

In the assessment of 12-month price targets, analysts unveil insights for BorgWarner, presenting an average target of $42.71, a high estimate of $52.00, and a low estimate of $34.00. A decline of 5.78% from the prior average price target is evident in the current average.

Interpreting Analyst Ratings: A Closer Look

The perception of BorgWarner by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Dan Levy | Barclays | Raises | Overweight | $44.00 | $40.00 |

| Alexander Potter | Piper Sandler | Announces | Overweight | $43.00 | - |

| Dan Levy | Barclays | Lowers | Overweight | $40.00 | $43.00 |

| Kash Rangan | Goldman Sachs | Lowers | Neutral | $34.00 | $38.00 |

| Colin Langan | Wells Fargo | Lowers | Overweight | $43.00 | $47.00 |

| Ryan Brinkman | JP Morgan | Lowers | Overweight | $52.00 | $59.00 |

| Dan Levy | Barclays | Lowers | Overweight | $43.00 | $45.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to BorgWarner. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of BorgWarner compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into BorgWarner's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on BorgWarner analyst ratings.

Discovering BorgWarner: A Closer Look

BorgWarner is a Tier I auto-parts supplier with three operating segments. The air management group makes turbochargers, e-boosters, e-turbos, timing systems, emissions systems, thermal systems, gasoline ignition technology, powertrain sensors, and cabin heaters. The drivetrain and battery systems group produces automatic transmission components, torque management products, battery heaters, battery charging, and battery modules. The e-propulsion segment makes e-motors, power electronics, and software and control modules. The company's largest customers are Ford and Volkswagen at 14% and 11% of 2023 revenue, respectively. Geographically, Europe accounted for 36% of 2023 revenue, while Asia and North America were 34% and 29% apiece.

Financial Milestones: BorgWarner's Journey

Market Capitalization: Boasting an elevated market capitalization, the company surpasses industry averages. This signals substantial size and strong market recognition.

Revenue Growth: Over the 3 months period, BorgWarner showcased positive performance, achieving a revenue growth rate of 6.18% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: BorgWarner's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 4.37%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): BorgWarner's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 2.66%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): BorgWarner's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of 1.08%, the company may face hurdles in achieving optimal financial performance.

Debt Management: BorgWarner's debt-to-equity ratio is below the industry average. With a ratio of 0.67, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.