Klaviyo KVYO has been analyzed by 9 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 4 | 2 | 0 | 0 |

| Last 30D | 0 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 1 | 1 | 0 | 0 |

| 2M Ago | 2 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 0 | 0 | 0 |

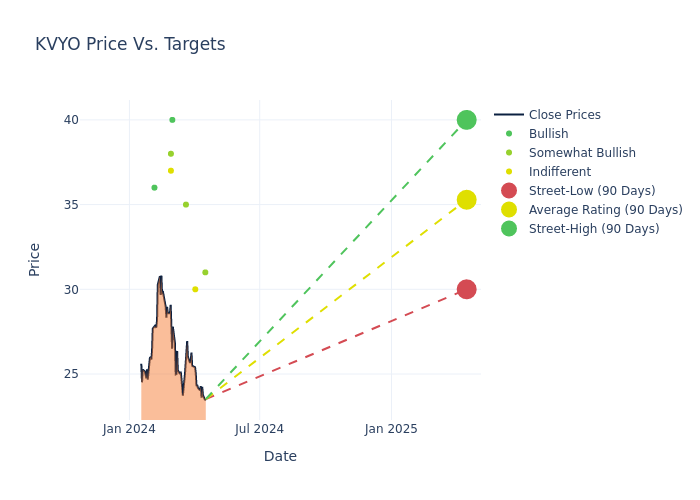

Analysts have set 12-month price targets for Klaviyo, revealing an average target of $36.11, a high estimate of $40.00, and a low estimate of $30.00. A 4.97% drop is evident in the current average compared to the previous average price target of $38.00.

Exploring Analyst Ratings: An In-Depth Overview

The standing of Klaviyo among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brett Knoblauch | Cantor Fitzgerald | Announces | Overweight | $31.00 | - |

| Nick Altmann | Scotiabank | Announces | Sector Perform | $30.00 | - |

| Shebly Seyrafi | FBN Securities | Announces | Outperform | $35.00 | - |

| Scott Berg | Needham | Maintains | Buy | $40.00 | - |

| Elizabeth Porter | Morgan Stanley | Lowers | Equal-Weight | $37.00 | $38.00 |

| Scott Berg | Needham | Maintains | Buy | $40.00 | - |

| Brent Bracelin | Piper Sandler | Maintains | Overweight | $38.00 | - |

| Gabriela Borges | Goldman Sachs | Announces | Buy | $36.00 | - |

| Brent Bracelin | Piper Sandler | Maintains | Overweight | $38.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Klaviyo. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Klaviyo compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Klaviyo's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Klaviyo analyst ratings.

Unveiling the Story Behind Klaviyo

Klaviyo Inc is a technology company that provides a software-as-a-service (SaaS) platform to enable its customers to send the right messages at the right time across email, short message service and push notifications, more accurately measure and predict performance, and deploy specific actions and campaigns. The platform combines proprietary data and application layers into one solution with machine learning and artificial intelligence capabilities. It is focused on marketing automation within eCommerce as its first application use case. It generates revenue through the sale of subscriptions to its customers for the use of its platform. Geographically the company generates the majority of its revenue from the Americas, followed by EMEA and APAC.

Financial Milestones: Klaviyo's Journey

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Klaviyo showcased positive performance, achieving a revenue growth rate of 38.82% as of 31 December, 2023. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Information Technology sector.

Net Margin: Klaviyo's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -13.04%, the company may face hurdles in effective cost management.

Return on Equity (ROE): The company's ROE is below industry benchmarks, signaling potential difficulties in efficiently using equity capital. With an ROE of -2.89%, the company may need to address challenges in generating satisfactory returns for shareholders.

Return on Assets (ROA): Klaviyo's ROA is below industry standards, pointing towards difficulties in efficiently utilizing assets. With an ROA of -2.43%, the company may encounter challenges in delivering satisfactory returns from its assets.

Debt Management: With a below-average debt-to-equity ratio of 0.06, Klaviyo adopts a prudent financial strategy, indicating a balanced approach to debt management.

The Core of Analyst Ratings: What Every Investor Should Know

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

If you want to keep track of which analysts are outperforming others, you can view updated analyst ratings along withanalyst success scores in Benzinga Pro.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

Edge Rankings

Price Trend

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.