4 analysts have expressed a variety of opinions on Innovid CTV over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table provides a quick overview of their recent ratings, highlighting the changing sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

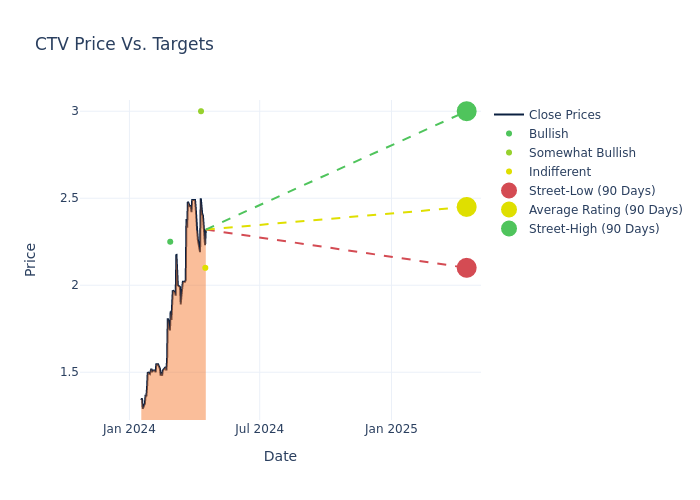

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $2.24, a high estimate of $3.00, and a low estimate of $1.60. This current average reflects an increase of 44.52% from the previous average price target of $1.55.

Diving into Analyst Ratings: An In-Depth Exploration

The perception of Innovid by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brian Nowak | Morgan Stanley | Raises | Equal-Weight | $2.10 | $1.60 |

| Andrew Boone | JMP Securities | Maintains | Market Outperform | $3.00 | - |

| Brian Nowak | Morgan Stanley | Raises | Equal-Weight | $1.60 | $1.50 |

| Laura Martin | Needham | Maintains | Buy | $2.25 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Innovid. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Innovid compared to the broader market.

- Price Targets: Analysts gauge the dynamics of price targets, providing estimates for the future value of Innovid's stock. This comparison reveals trends in analysts' expectations over time.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Innovid's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Innovid analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

Delving into Innovid's Background

Innovid Corp is a software platform that provides ad serving, measurement and optimization creative services for the creation, delivery, and measurement of TV ads across connected TV, mobile TV and desktop TV environments to advertisers, publishers and media agencies. It is engaged in ad serving, measurement and creative services. It operates in U.S., Canada, EMEA, APAC and LATAM, out of which it derives maximum revenue from U.S.

Financial Milestones: Innovid's Journey

Market Capitalization Perspectives: The company's market capitalization falls below industry averages, signaling a relatively smaller size compared to peers. This positioning may be influenced by factors such as perceived growth potential or operational scale.

Revenue Growth: Innovid's remarkable performance in 3 months is evident. As of 31 December, 2023, the company achieved an impressive revenue growth rate of 14.6%. This signifies a substantial increase in the company's top-line earnings. When compared to others in the Communication Services sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Innovid's net margin excels beyond industry benchmarks, reaching -4.29%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Innovid's ROE excels beyond industry benchmarks, reaching -0.85%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Innovid's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of -0.67%, the company showcases efficient use of assets and strong financial health.

Debt Management: Innovid's debt-to-equity ratio is below the industry average at 0.11, reflecting a lower dependency on debt financing and a more conservative financial approach.

How Are Analyst Ratings Determined?

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.