Ratings for Caterpillar CAT were provided by 9 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The following table summarizes their recent ratings, shedding light on the changing sentiments within the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 2 | 3 | 1 | 0 |

| Last 30D | 1 | 1 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 0 | 1 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 1 | 0 |

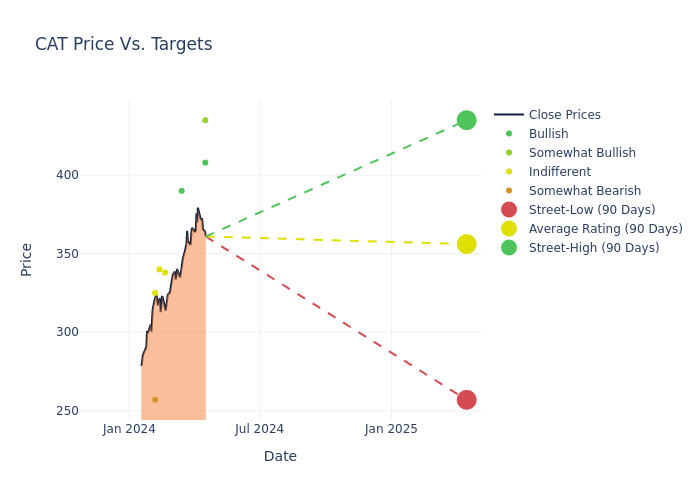

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $359.44, a high estimate of $435.00, and a low estimate of $257.00. This current average reflects an increase of 18.0% from the previous average price target of $304.62.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Caterpillar's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tami Zakaria | JP Morgan | Raises | Overweight | $435.00 | $385.00 |

| Jerry Revich | Goldman Sachs | Raises | Buy | $408.00 | $357.00 |

| Jamie Cook | Truist Securities | Announces | Buy | $390.00 | - |

| David Raso | Evercore ISI Group | Raises | In-Line | $338.00 | $321.00 |

| Timothy Thein | Citigroup | Raises | Neutral | $340.00 | $255.00 |

| Tami Zakaria | JP Morgan | Raises | Overweight | $385.00 | $345.00 |

| Mircea Dobre | Baird | Raises | Underperform | $257.00 | $210.00 |

| Seth Weber | Wells Fargo | Raises | Equal-Weight | $325.00 | $290.00 |

| Jerry Revich | Goldman Sachs | Raises | Buy | $357.00 | $274.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Caterpillar. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Caterpillar compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Caterpillar's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Understanding these analyst evaluations alongside key financial indicators can offer valuable insights into Caterpillar's market standing. Stay informed and make well-considered decisions with our Ratings Table.

Stay up to date on Caterpillar analyst ratings.

About Caterpillar

Caterpillar is the premier manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment with over 13% market share in 2021. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Caterpillar Financial Services. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Caterpillar Financial Services provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

Caterpillar: Delving into Financials

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Caterpillar's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 2.85%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Industrials sector, the company faces challenges, achieving a growth rate lower than the average among peers.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 15.68%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Caterpillar's ROE excels beyond industry benchmarks, reaching 13.39%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Caterpillar's ROA excels beyond industry benchmarks, reaching 3.07%. This signifies efficient management of assets and strong financial health.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.94, caution is advised due to increased financial risk.

How Are Analyst Ratings Determined?

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.