In the latest quarter, 12 analysts provided ratings for Equinix EQIX, showcasing a mix of bullish and bearish perspectives.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 3 | 7 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 1 | 1 | 2 | 0 | 0 |

| 2M Ago | 1 | 1 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 3 | 0 | 0 |

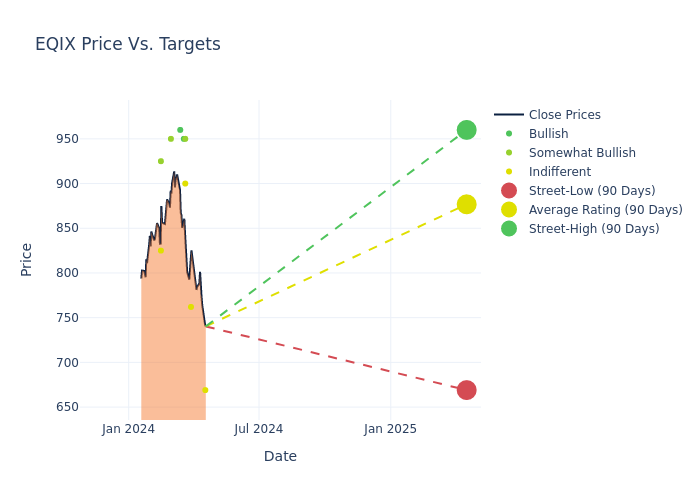

In the assessment of 12-month price targets, analysts unveil insights for Equinix, presenting an average target of $795.92, a high estimate of $960.00, and a low estimate of $91.00. Witnessing a positive shift, the current average has risen by 5.74% from the previous average price target of $752.70.

Analyzing Analyst Ratings: A Detailed Breakdown

The perception of Equinix by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Brendan Lynch | Barclays | Lowers | Equal-Weight | $669.00 | $818.00 |

| Simon Flannery | Morgan Stanley | Lowers | Equal-Weight | $762.00 | $767.00 |

| Phani Kanumuri | HSBC | Announces | Hold | $900.00 | - |

| Timothy Horan | Oppenheimer | Raises | Outperform | $950.00 | $875.00 |

| Anthony Hau | Truist Securities | Raises | Buy | $950.00 | $915.00 |

| Erik Rasmussen | Stifel | Maintains | Buy | $960.00 | - |

| Brendan Lynch | Barclays | Raises | Equal-Weight | $91.00 | $79.00 |

| Jonathan Atkin | RBC Capital | Raises | Outperform | $950.00 | $855.00 |

| Eric Luebchow | Wells Fargo | Raises | Equal-Weight | $825.00 | $800.00 |

| Ari Klein | BMO Capital | Raises | Outperform | $925.00 | $910.00 |

| Brendan Lynch | Barclays | Lowers | Equal-Weight | $781.00 | $788.00 |

| Brendan Lynch | Barclays | Raises | Equal-Weight | $788.00 | $720.00 |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Equinix. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of Equinix compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of Equinix's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on Equinix analyst ratings.

All You Need to Know About Equinix

Equinix operates 260 data centers in 71 markets worldwide. It generates 44% of total revenue in the Americas, 35% in Europe, the Middle East, and Africa, and 21% in Asia-Pacific. The firm has more than 10,000 customers, including 2,100 network providers, that are dispersed over five verticals: cloud and IT services, content providers, network and mobile services, financial services, and enterprise. About 70% of Equinix's revenue comes from renting space to tenants and related services, and more than 15% comes from interconnection. Equinix operates as a real estate investment trust.

Equinix: Delving into Financials

Market Capitalization Highlights: Above the industry average, the company's market capitalization signifies a significant scale, indicating strong confidence and market prominence.

Revenue Growth: Equinix's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 12.81%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: Equinix's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 10.78%, the company may face hurdles in effective cost management.

Return on Equity (ROE): Equinix's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.87%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): Equinix's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.71%, the company may face hurdles in achieving optimal financial returns.

Debt Management: Equinix's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.4.

Analyst Ratings: What Are They?

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Beyond their standard evaluations, some analysts contribute predictions for metrics like growth estimates, earnings, and revenue, furnishing investors with additional guidance. Users of analyst ratings should be mindful that this specialized advice is shaped by human perspectives and may be subject to variability.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.