Analysts' ratings for Lovesac LOVE over the last quarter vary from bullish to bearish, as provided by 4 analysts.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 0 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 3 | 0 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

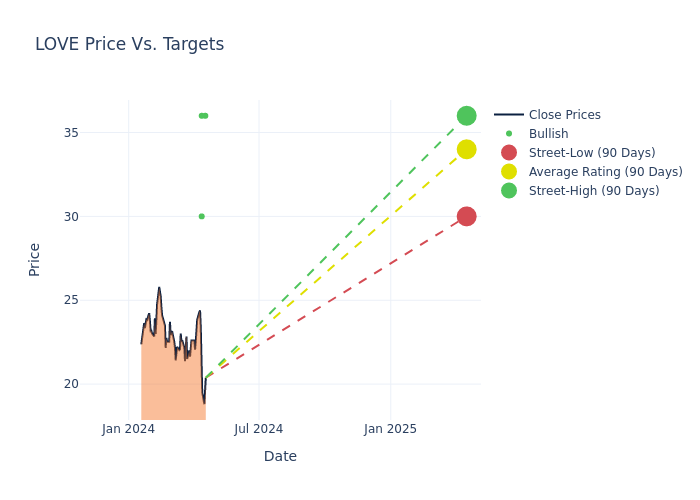

Analysts' evaluations of 12-month price targets offer additional insights, showcasing an average target of $34.0, with a high estimate of $36.00 and a low estimate of $30.00. Experiencing a 12.82% decline, the current average is now lower than the previous average price target of $39.00.

Breaking Down Analyst Ratings: A Detailed Examination

A comprehensive examination of how financial experts perceive Lovesac is derived from recent analyst actions. The following is a detailed summary of key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Tom Forte | Maxim Group | Announces | Buy | $36.00 | - |

| Maria Ripps | Canaccord Genuity | Lowers | Buy | $36.00 | $44.00 |

| Matt Koranda | Roth MKM | Lowers | Buy | $30.00 | $34.00 |

| Matt Koranda | Roth MKM | Announces | Buy | $34.00 | - |

Key Insights:

- Action Taken: Responding to changing market dynamics and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their response to recent developments related to Lovesac. This offers insight into analysts' perspectives on the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Lovesac compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Lovesac's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

To gain a panoramic view of Lovesac's market performance, explore these analyst evaluations alongside essential financial indicators. Stay informed and make judicious decisions using our Ratings Table.

Stay up to date on Lovesac analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

All You Need to Know About Lovesac

The Lovesac Co designs, manufactures and sells alternative furniture which is comprised of modular couches called sactionals and premium foam beanbag chairs called sacs. It also offers other accessories such as sactional-specific drink holders, Footsac blankets, decorative pillows, fitted seat tables, and ottomans. Its products are sold across the United States through its website or company-owned retail stores which are used in homes and offices. The majority of the firm's revenue is derived from the sale of Sactionals.

Lovesac: Delving into Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Lovesac's remarkable performance in 3 months is evident. As of 31 January, 2024, the company achieved an impressive revenue growth rate of 5.04%. This signifies a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Discretionary sector.

Net Margin: Lovesac's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 12.36% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Lovesac's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 15.36% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): The company's ROA is a standout performer, exceeding industry averages. With an impressive ROA of 6.74%, the company showcases effective utilization of assets.

Debt Management: Lovesac's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 0.81.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.