In the preceding three months, 5 analysts have released ratings for First Industrial Realty FR, presenting a wide array of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 1 | 0 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 0 | 1 | 0 | 0 |

| 2M Ago | 1 | 1 | 0 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

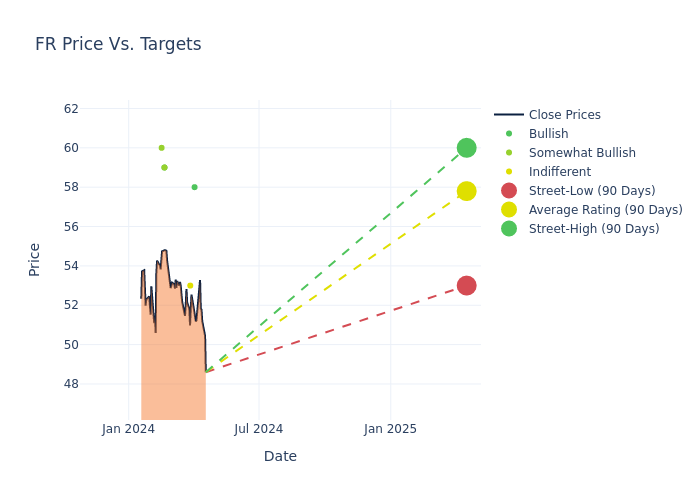

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $57.8, a high estimate of $60.00, and a low estimate of $53.00. Observing a 1.76% increase, the current average has risen from the previous average price target of $56.80.

Interpreting Analyst Ratings: A Closer Look

The perception of First Industrial Realty by financial experts is analyzed through recent analyst actions. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Vikram Malhorta | Mizuho | Maintains | Buy | $58.00 | $58.00 |

| Anthony Powell | Barclays | Lowers | Equal-Weight | $53.00 | $63.00 |

| Michael Mueller | JP Morgan | Raises | Overweight | $59.00 | $51.00 |

| Ki Bin Kim | Truist Securities | Raises | Buy | $59.00 | $57.00 |

| Michael Carroll | RBC Capital | Raises | Outperform | $60.00 | $55.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to First Industrial Realty. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Unveiling insights, analysts deliver qualitative insights into stock performance, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of First Industrial Realty compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of First Industrial Realty's stock. This comparison reveals trends in analysts' expectations over time.

For valuable insights into First Industrial Realty's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on First Industrial Realty analyst ratings.

Unveiling the Story Behind First Industrial Realty

First Industrial Realty Trust Inc is a real estate investment trust that owns, manages, acquires, sells, develops, and redevelops industrial real estate. First Industrial's real estate portfolio is comprised of light industrial properties, which are split between industrial and office space, and bulk warehouse properties generally located in business parks near transportation hubs. While light industrial buildings represent a share of First Industrial's holdings, bulk warehouses make up the majority of its portfolio's square footage. The company derives the vast majority of its revenue from rental income tied to medium-term leases. First Industrial's customers include manufacturing, retail, wholesale trade, distribution, and professional services companies.

First Industrial Realty's Financial Performance

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: First Industrial Realty's revenue growth over a period of 3 months has been noteworthy. As of 31 December, 2023, the company achieved a revenue growth rate of approximately 8.76%. This indicates a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company stands out with a growth rate higher than the average among peers in the Real Estate sector.

Net Margin: First Industrial Realty's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 56.68% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): First Industrial Realty's ROE stands out, surpassing industry averages. With an impressive ROE of 3.5%, the company demonstrates effective use of equity capital and strong financial performance.

Return on Assets (ROA): First Industrial Realty's financial strength is reflected in its exceptional ROA, which exceeds industry averages. With a remarkable ROA of 1.73%, the company showcases efficient use of assets and strong financial health.

Debt Management: First Industrial Realty's debt-to-equity ratio is below the industry average. With a ratio of 0.88, the company relies less on debt financing, maintaining a healthier balance between debt and equity, which can be viewed positively by investors.

Understanding the Relevance of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Some analysts also offer predictions for helpful metrics such as earnings, revenue, and growth estimates to provide further guidance as to what to do with certain tickers. It is important to keep in mind that while stock and sector analysts are specialists, they are also human and can only forecast their beliefs to traders.

This article was generated by Benzinga's automated content engine and reviewed by an editor.

© 2025 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

date | ticker | name | Price Target | Upside/Downside | Recommendation | Firm |

|---|

Trade confidently with insights and alerts from analyst ratings, free reports and breaking news that affects the stocks you care about.